Quantifying Uncertainty in Linear Regression Models

Module 12

Learning Objectives

By the end of this Module, you should be able to:

- Explain what uncertainty means in a linear regression context and why it arises

- Describe how sample-to-sample variability affects regression intercepts, slopes, and fit statistics (e.g., \(R^2\), \(\sigma\))

- Compute and interpret the standard error of regression coefficients

- Construct and interpret confidence intervals (CIs) for the slope, intercept, fitted means, and future observations

- Implement bootstrap resampling to approximate the sampling distribution of regression parameters and derive SEs and CIs

- Apply theory-based (parametric) formulas to obtain SEs and CIs when model assumptions hold

- Differentiate a confidence interval for the mean response from a prediction interval for a new response

- Compare frequentist and Bayesian frameworks for quantifying regression uncertainty, including the use of credible intervals

- Visualize Bayesian uncertainty with tools such as confidence/credible bands, histograms, half-eye plots, and posterior-predictive lines

Overview

In the last two Modules, you learned how to fit a linear regression model and interpret its coefficients. But here’s a critical question: How confident should you be in those estimates?

Regression models are built using sample data — and every sample is just one of many possible samples you could have drawn. This means your estimated slopes and intercepts will vary from sample to sample. That’s where the concept of uncertainty comes in.

In this Module, you’ll explore how to quantify and interpret uncertainty in regression models. You’ll learn how tools like bootstrapping, standard errors, and confidence intervals help us understand the stability of our estimates. You’ll also get a taste of Bayesian methods, which offer an alternative way to express uncertainty.

By the end of this module, you’ll be better equipped to answer questions like:

“How much could this slope vary if I collected new data?”

“How confident am I that this predictor actually matters?”

“What does my confidence interval estimate for the effect of a key predictor really mean?”

Understanding uncertainty doesn’t just make you a better data analyst — it helps you draw more honest, thoughtful conclusions from your models.

Introduction to the Data

In this Module we will study the impact of weather conditions on bicycle usage in New York City. To begin, we will start with data from 2023. The data were compiled from two sources:

Bicycle Count Data: This dataset, from the NYC Open Data portal’s “Bicycle Counts” frame, includes daily bike counts from 32 counters across the city. These counters track cycling trends to support infrastructure planning and safety efforts, as well as to promote biking. The map below shows the locations of the counters.

Weather Data: Weather data was collected using the openmeteo R package, which accesses historical data from Open-Meteo. Key variables include daily high and low temperatures, apparent temperature, precipitation, and wind speed — all useful for examining how weather affects cycling behavior.

We can pull in the weather data using the following code:

library(openmeteo)

nyc_weather_2023 <-

weather_history("NYC",

start = "2023-01-01",

end = "2023-12-31",

daily = c("temperature_2m_max",

"temperature_2m_min",

"apparent_temperature_max",

"apparent_temperature_min",

"precipitation_sum",

"precipitation_hours",

"wind_speed_10m_max")

) `geocode()` has matched "NYC" to:

New York in New York, United States

Population: 8804190

Co-ordinates: c(40.71427, -74.00597)I used these two data sources to compile a data frame for this Module, it’s called nyc_bikes_2023.Rds. Each row of data represents one day in 2023. The following variables are included:

| Variable | Description |

|---|---|

| date | Date for observation |

| total_counts | Total number of bikes recorded by 32 bike counters dispersed throughout New York City |

| daily_temperature_2m_max | Maximum daily air temperature (Celsius) at 2 meters above ground |

| daily_temperature_2m_min | Minimum daily air temperature (Celsius) at 2 meters above ground |

| daily_apparent_temperature_max | Maximum daily apparent temperature (Celsius) |

| daily_apparent_temperature_min | Minimum daily apparent temperature (Celsius |

| daily_precipitation_sum | Sum (millimeters) of daily precipitation (including rain, showers and snowfall) |

| daily_precipitation_hours | The number of hours with rain |

| daily_wind_speed_10m_max | Maximum wind speed (in km/hr) on a day |

Let’s load the packages that we will need in this Module.

library(broom)

library(broom.mixed)

library(gtsummary)

library(gt)

library(brms)

library(tidybayes)

library(bayesrules)

library(skimr)

library(here)

library(tidyverse)Now, we can import the data frame, called nyc_bikes_2023.Rds.

nyc_bikes_2023 <- read_rds(here("data", "nyc_bikes_2023.Rds"))

nyc_bikes_2023 |> head()Visualize the Data

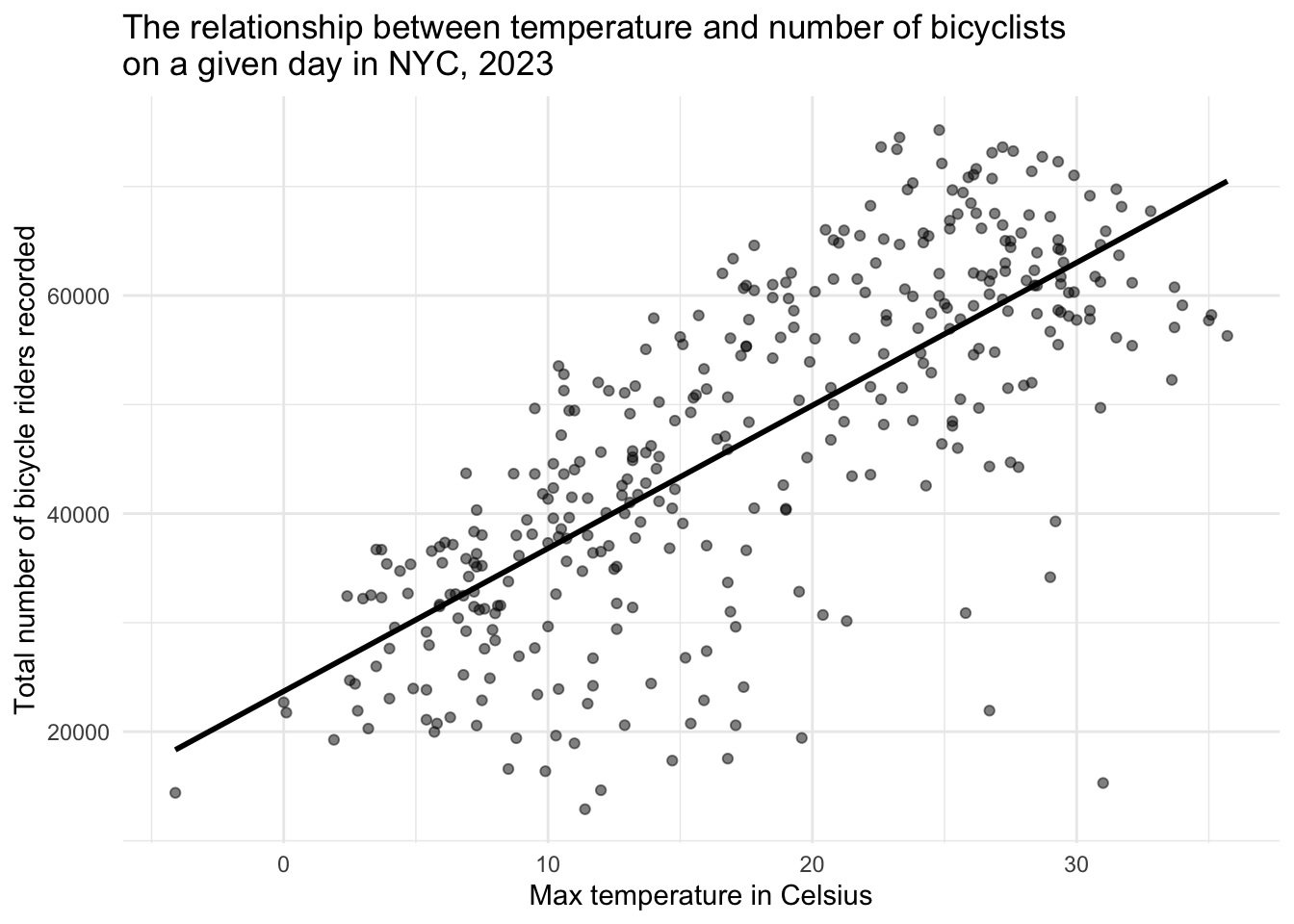

We’ll begin with a quick exploratory look: a scatterplot of total_counts versus daily_temperature_2m_max, overlaid with a best-fit line to reveal the underlying trend between temperature and bike volume.

The scatterplot above shows the relationship between the maximum daily temperature (in Celsius) and the total number of bicycle riders recorded on that day in New York City in 2023. Each point represents one day of the year. A clear positive trend is visible: as temperatures rise, more people tend to ride bicycles. The superimposed best-fit line helps highlight this upward trend.

In this Module, we’ll use this relationship as a working example. You’ll learn how to quantify the uncertainty in the estimated slope and intercept of the regression line and explore tools — like standard errors, confidence intervals, and bootstrapping — that help us answer a critical question in applied regression:

How confident can we be in the parameters estimated from our sample data?

A Simple Linear Regression Model

The equation

A SLR model attempts to explain the relationship between two variables through a linear equation of the form:

\[ {y_i} = b_0 + b_1x_i + e_i \]

Where:

\(y_i\) is the dependent variable/outcome (in this case, total_counts), which we are trying to predict or explain.

\(x_i\) is the independent variable/predictor (here, daily_temperature_2m_max) that we believe might predict \(y_i\).

\(b_0\) is the intercept — the expected value of \(y_i\) when \(x_i = 0\).

\(b_1\) is the slope — the expected change in \(y_i\) for a one-unit increase in \(x_i\).

\(e_i\) represents the residual, accounting for the variation in the \(y_i\) scores not explained by the \(x_i\) scores.

Fit the model

We can fit the model using the lm() function:

slr <- lm(total_counts ~ daily_temperature_2m_max, data = nyc_bikes_2023)Interpretation of the intercept and slope

Now, let’s take a look at the regression coefficients using tidy().

slr |>

tidy() |>

select(term, estimate)Take a moment to interpret the intercept and slope and then check your answers below.

The estimate for the intercept (23712) represents the expected number of bikes recorded (total_counts) when the maximum daily temperature (daily_temperature_2m_max) is 0 degrees Celsius. In practical terms, this can be thought of as the baseline number of bicycles counted on a cold day with 0°C (which is 32°F) as the maximum temperature.

The estimate for the slope (1310) indicates that, on average, for each 1°C increase in the maximum daily temperature, the total number of bikes counted increases by approximately 1310 bikes. This positive coefficient suggests that warmer temperatures are associated with higher bicycle usage, possibly due to more people choosing to bike under comfortable weather conditions.

Interpretation of overall model fit

The results of glance() provide some additional information about the overall model fit.

slr |> glance() |> select(r.squared, sigma)Take a moment to interpret the \(R^2\) and sigma, then check your answers below.

The \(R^2\), labeled r.squared in the output, is 0.556 and measures the proportion of the variance in the outcome/dependent variable (total_counts) that is predictable from the predictor/independent variable (daily_temperature_2m_max). In this example, approximately 56% of the variation in daily bike counts can be explained by the variation in maximum daily temperature. This is a substantial proportion, indicating that the maximum daily temperature is a good predictor of bike usage in New York City, though there is still a considerable amount of variation that is not predicted by this model alone (i.e., ~ 44%).

The residual standard error (labeled sigma) gives an estimate of the standard deviation of the residuals, which are the differences between observed values and the values predicted by the model. In this context, a sigma of ~10260 means that the typical prediction for the total bike counts deviates from the actual bike counts by about 10,260 bikes, on average. This provides a measure of the accuracy of the predictions made by the model; a lower sigma would indicate more precise predictions.

Use the model to make predictions

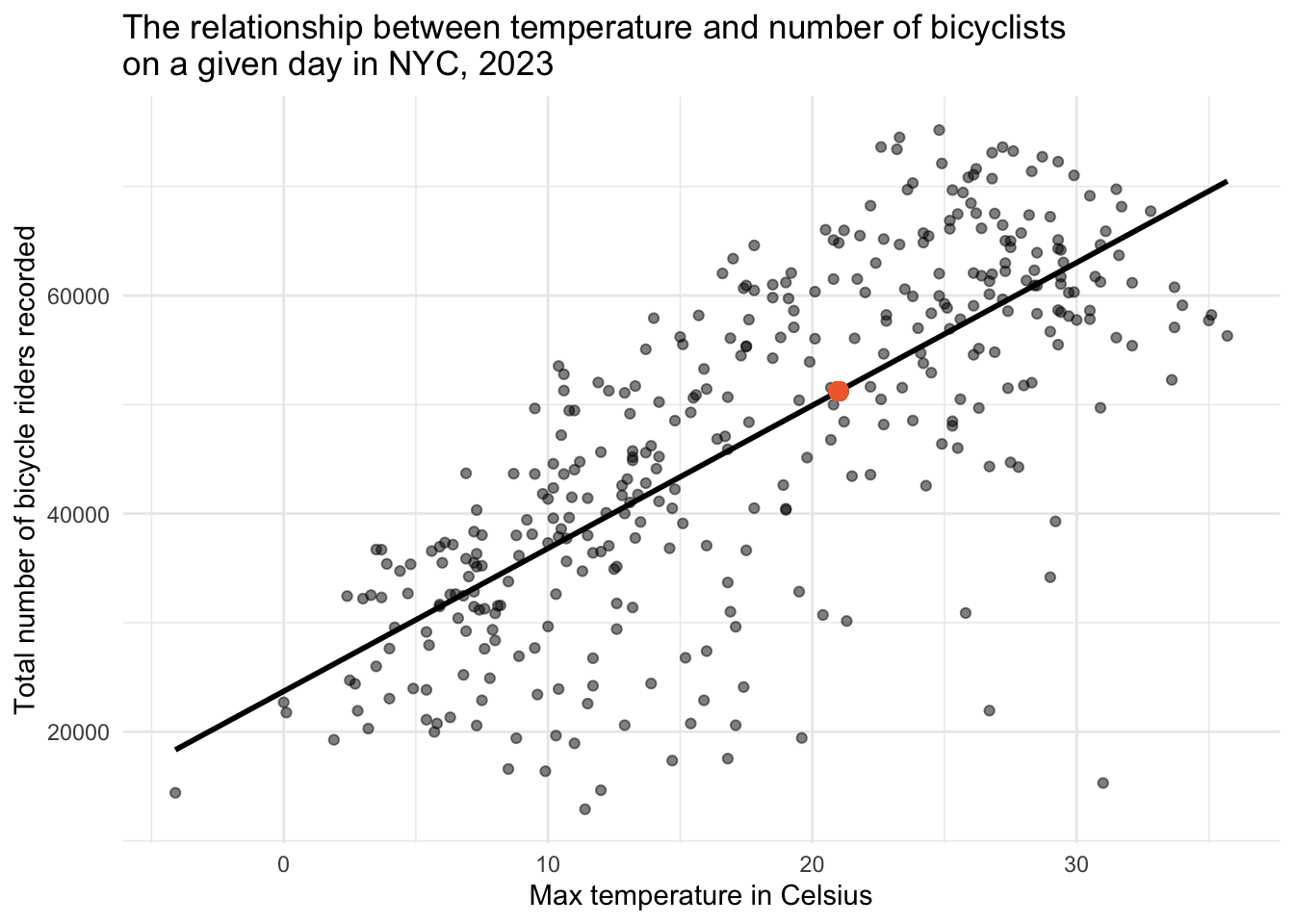

We can also use the fitted model to predict outcomes based on specific values of predictors. For instance, in our analysis of bicycle ridership, we might be interested in forecasting the number of riders on a day when the maximum temperature is 21°C (approximately 70°F).

Use the results of tidy() to compute the predicted number of riders on a 21°C day, then check your answer below.

To facilitate this, we can employ the predict() function in R:

# Create a data frame with the desired predictor values

new_data <- data.frame(daily_temperature_2m_max = 21)

# Utilize the linear model to predict outcomes based on new data

slr |> predict(newdata = new_data) 1

51229.46 Of course, we can easily do this manually (using the tidy() output) as follows:

23711.546 + (1310.377 * 21)[1] 51229.46Our computation suggests that, on a day where the maximum temperature is 21°C, we anticipate around 51,229 bicycle riders. This value is depicted by the orange circle in the graph below.

Understanding Sample-to-Sample Variability

When we conduct a study using sample data, we are essentially capturing a snapshot of the real world under specific conditions and at a specific time. In the case of our bike counts and temperature study, the data for 2023 represents one possible realization of many that could occur. Our ultimate goal is to understand the underlying relationship in the broader population — the true connection between temperature and cycling activity — but we only have access to a sample. Various factors contribute to sample-to-sample variability in this context. For example:

Weather Variability: Weather conditions can vary significantly from year to year, including temperature patterns, precipitation, and extreme weather events. Since our study focuses on the relationship between bike counts and maximum daily temperature, different weather conditions in other random samples (e.g., different years) could lead to different observations and, consequently, different estimates of the effect of temperature on bike usage.

Changes in City Infrastructure and Policies: Over time, New York City might implement new bike lanes, bike-sharing programs, or policies affecting transportation. Such changes can influence people’s willingness to bike and could affect the relationship between temperature and biking behavior observed in different samples.

Population Changes and Cultural Shifts: The population of a city is not static; people move in and out, and cultural attitudes towards biking and outdoor activities can shift. These changes can influence the number of people who choose to bike under various weather conditions, adding to the variability between different samples that could have been collated.

Variability in Data Collection Locations: The placement of bike counters throughout the city is a critical factor in measuring bike usage. If these counters were positioned at slightly different locations, perhaps capturing areas with different traffic patterns or proximities to popular destinations, the recorded bike counts could vary. For instance, counters placed closer to parks or bike paths might record more activity on warm days compared to those placed in more industrial areas with less recreational cycling.

Precision in Temperature Measurement: The accuracy and precision with which temperature and other weather conditions are measured can also influence the observed relationship between temperature and bike usage. Variations in the placement of temperature sensors, their calibration, or the model of the sensors used can lead to slight differences in recorded temperatures, potentially affecting the estimated impact of temperature on biking behavior.

Influence of Unmeasured Environmental and Social Factors: Beyond the placement of counters and the precision of temperature measurements, other environmental and social factors that aren’t captured in the dataset can contribute to variability. These might include temporary road closures, construction work, special events that either encourage or deter biking, and even shifts in public transportation availability.

The implications of variability

Every dataset is only one of many possible random samples we could have drawn. If we collected the same information next year — or even next week — the fitted slope, intercept, and \(R^2\) would shift slightly. That built-in wobble is sample-to-sample variability.

Recognising this fact changes how we think:

Point estimates are not enough. A single slope or intercept tells us the best guess for this sample, but says nothing about how far those numbers might drift in a new sample.

Intervals and standard errors are essential. They translate the invisible sampling variation into concrete margins of error, letting us judge whether an apparent effect is rock-solid or could easily vanish with different data.

Inference, not just description. By attaching measures of uncertainty, we move from “what happened in this one sample?” to “what’s plausible for the population?” — the real goal of statistical modelling.

In short, embracing sample-to-sample variability pushes us to quantify uncertainty and leads to conclusions that remain trustworthy even when the data (inevitably) change.

Intuition for uncertainty in a SLR

When fitting a linear regression model, we are interested in estimating the population parameters of the linear regression model (i.e., the intercept, slope(s), and \(R^2\)) using our sample data.

The population equation represents the idealized, true relationship between the predictor(s) and the outcome across the entire population of interest. This equation is often what we aim to estimate through statistical modeling, but it remains unknown and must be inferred from sample data that we collect.

The population equation that relates a predictor variable (X) to an outcome variable (Y) may be written as follows:

\[ Y_i = \beta_0 + \beta_1X_i + \epsilon_i \]

Here:

- \(Y_i\) is the value of the response variable for the \(i^{th}\) case in the population.

- \(\beta_0\) is the true intercept of the population regression line, representing the expected value of \(Y\) when \(X = 0\).

- \(\beta_1\) is the true slope of the population regression line, indicating how much \(Y\) is expected to change with a one-unit increase in \(X\).

- \(X_i\) is the value of the predictor variable for the \(i^{th}\) case in the population.

- \(\epsilon_i\) represents the error term for the \(i^{th}\) case, capturing all other factors affecting \(Y\) besides \(X\) and inherently includes the variability in \(Y\) not explained by \(X\). The error term, \(\epsilon_i\), follows a normal distribution with a mean of 0 and a standard deviation of \(\sigma\), denoted as \(\epsilon_i \sim N(0, \sigma^2)\). This represents the randomness or noise in the relationship between \(X\) and \(Y\).

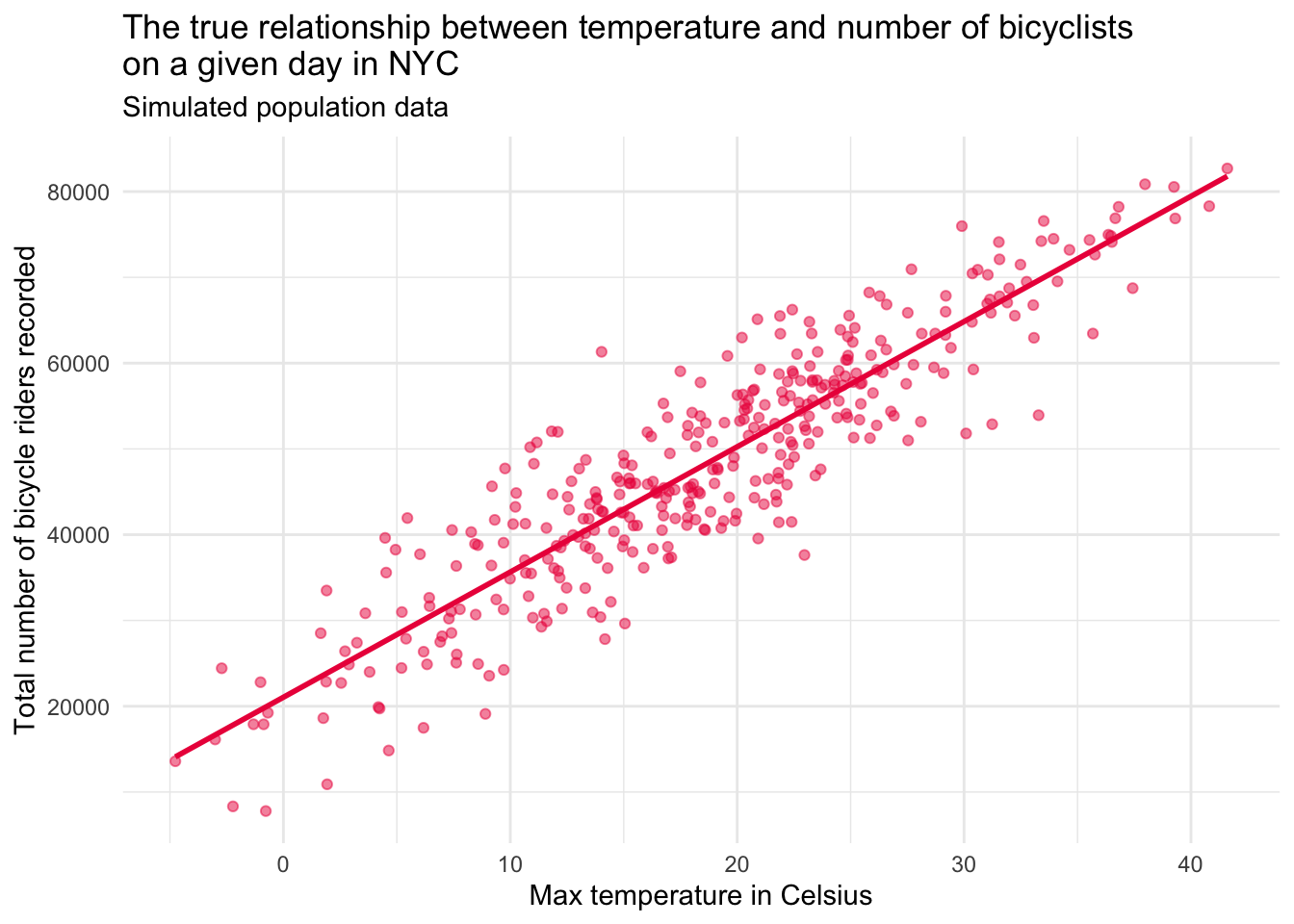

Consider a hypothetical scenario where we magically know the true relationship between the daily maximum temperature (\(X_i\)) and the number of bike riders (\(Y_i\)) in New York City.

\[Y_i = 21000 + 1450X_i + \epsilon_i\]

This equation asserts that if the daily maximum temperature is 0°C, the predicted number of bicycle riders recorded by counters is 21,000 for a particularly day. And, that for each 1°C increase in max daily temperature, we expect that the counters will record 1450 additional riders for the day.

In practice, we don’t know the true values of \(\beta_0\), \(\beta_1\), or \(\epsilon_i\), so we estimate them using sample data. The sample equation is formulated as:

\[ \hat{y_i} = b_0 + b_1x_i + e_i \]

- \(\hat{y_i}\) is the predicted value of the response variable for the \(i^{th}\) case in the sample.

- \(b_0\) and \(b_1\) are the estimates of the intercept and slope, respectively, obtained from the sample.

- \(x_i\) is the observed value of the predictor variable for the \(i^{th}\) case in the sample.

- \(e_i\) is the residual for the \(i^{th}\) case, representing the difference between the observed value and the predicted value of the response variable: \(e_i = y_i - \hat{y_i}\).

Contrasting population and sample equations

When we build a regression model, it’s helpful to distinguish between these two versions of the equation: one for the population and one for the sample.

Parameters vs. Estimates

In the population equation, the values for the intercept and slope — written as \(\beta_0\) and \(\beta_1\) — are called parameters. These represent the true relationship between the variables in the entire population. But we don’t know their exact values because we rarely have access to ALL of the data in the defined population.

In the sample equation, we use data from a sample to estimate those parameters. We call these estimates \(b_0\) and \(b_1\). These are our best guesses for what \(\beta_0\) and \(\beta_1\) are, based on the sample we collected.

Error Terms: \(\epsilon_i\) vs. \(e_i\)

In the population equation, the error term \(\epsilon_i\) represents the unknown factors that cause a case’s actual score to differ from the true prediction. These errors are part of the natural variability in the population, and we can’t directly observe them.

In the sample equation, we work with residuals, written as \(e_i\). A residual is the difference between a case’s actual score and the predicted score from our sample-based model. These are observable because they come directly from our data.

In summary, the population equation reflects the true relationship we’re trying to understand, while the sample equation gives us the best approximation of that truth based on our data. By analyzing sample data carefully, we’re able to learn about the broader population — even though we never see it directly.

Let’s play make-believe

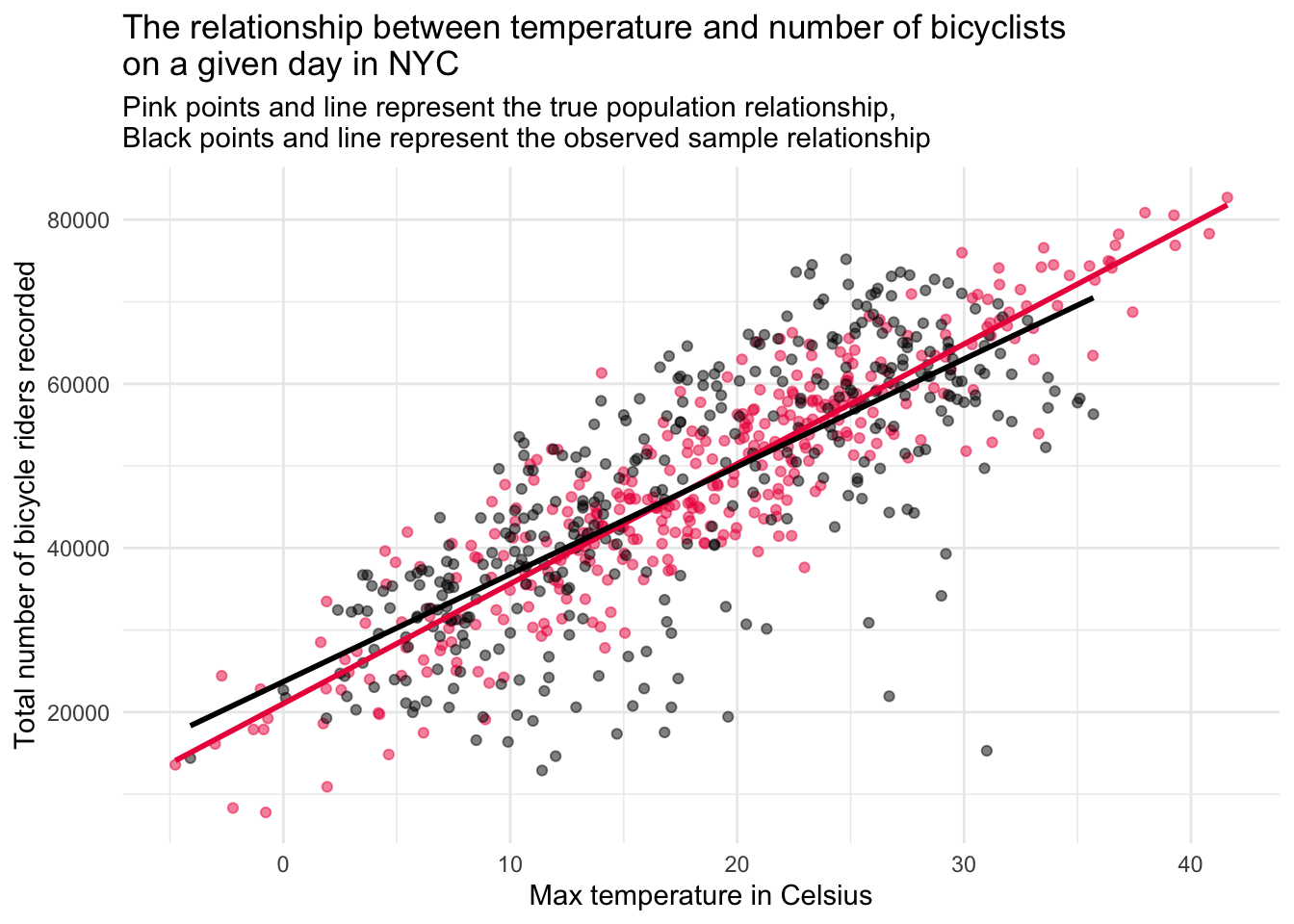

Let’s imagine that we had the true population data. The graph below depicts this simulated population.

Contrast the population and sample data

Now, let’s enhance this graph to include both the simulated population data (in pink), and the real sample data collected in 2023 (in grey).

Interpreting the two‐line plot

The figure overlays:

Pink points & line: Asimulated “true” population relationship between daily maximum temperature and bike counts.

Grey points & line: The relationship we actually observed in the 2023 sample.

These two overlays reveal two separate kinds of error:

Sampling error (grey vs. pink line)

Even if our model is perfectly specified, the grey regression line rarely lands exactly on the pink one.

That gap is sampling error — the random discrepancy between a finite sample’s estimates and the true population relationship. It arises because the observations we happened to record (one particular year, set of days, and set of conditions) are just one of many equally plausible draws; a different sample would include a different mix of hot, cold, rainy, or holiday days and would trace out a slightly different regression line.

It reminds us that a new sample would produce a slightly different slope and intercept.

Prediction (residual) error (vertical spread around either line)

Both the pink and grey lines miss many points; those vertical deviations are residuals.

Residual error comes from measurement noise, day-to-day quirks (holidays, parades, rain bursts), and any model misspecification (e.g., omitted variables or a non-linear pattern).

Even with the true regression line in hand, we would still see scatter because temperature is not the only driver of bike use.

Why we care

Sampling error → motivates tools that quantify estimation uncertainty (standard errors, confidence/credible intervals, bootstrapping).

Prediction error → motivates better models (additional predictors, non-linear terms) and alerts us to the limits of forecasting individual outcomes.

Together, these errors highlight why point estimates alone are never enough: we must report — and interpret — the uncertainty that surrounds them.

Uncertainty in Regression Models

In Modules 08 and 09, we explored how sample statistics (like means and proportions) can vary from one sample to the next — and how we can measure that uncertainty using standard errors, confidence intervals, bootstrapping, and even Bayesian methods.

Now we’re bringing those same ideas into the world of regression.

When we fit a SLR model, we’re estimating two key parameters that define the best fit line: the intercept and the slope. But just like a sample mean, these numbers aren’t exact — they’re estimates based on one sample. If we collected a different sample, we’d likely get slightly different results.

That’s where standard errors come in. They help us understand how much the intercept and slope might vary from sample to sample. A small standard error means our estimate is likely pretty stable across different samples. A large standard error means there’s more uncertainty — the data are more scattered, and the slope could change a lot depending on which cases we happened to sample.

In this Module, you’ll learn how to apply everything you’ve already practiced to quantify uncertainty — bootstrapping, theory-based methods, and Bayesian thinking — to understand how sure we are about the regression line we’ve fit.

Understanding uncertainty the frequentist way

Back in Module 09, you learned two different frequentist ways to estimate uncertainty when working with sample statistics — like a proportion (e.g., the proportion of adolescents with a past-year Major Depressive Episode) or a mean (e.g., the average severity of depression symptoms). These two approaches were:

Bootstrapping: Which uses resampling to estimate variability directly from our data, without needing strong assumptions, and

Theory-based (parametric): Which uses mathematical formulas and assumptions about the data (like assuming it’s normally distributed).

In this section, you’ll see how we apply those same two ideas to estimate uncertainty in regression coefficients.

Bootstrapping: A simulation-based approach to uncertainty

The bootstrap lets us approximate how much our regression estimates (like the slope) might vary from sample to sample — without needing complicated math or strong assumptions about how the data are distributed.

Instead of relying on formulas, bootstrapping uses your actual dataset as a stand-in for the population. Here’s the basic idea:

We randomly draw a new sample with replacement from our original data — this is called a bootstrap resample.

Each resample is the same size as the original (in our case, 365 days), but because we’re sampling with replacement, some days might show up more than once, and others not at all.

We then fit our regression model to this new resample and record the regression parameter estimates.

By repeating this process many times, we build a simulated sampling distribution for each regression parameter estimate — which tells us how much those estimates tend to vary from sample to sample.

This gives us a practical way to compute standard errors and build confidence intervals — just like we did for means and proportions in earlier Modules, but now applied to regression estimates.

A single bootstrap resample

Let’s walk through how to generate one bootstrap resample using the nyc_bikes_2023 data frame. This will give you a hands-on feel for how bootstrapping works in the context of regression. The code chunk below accomplishes this task:

set.seed(12345)

resample1 <-

nyc_bikes_2023 |>

select(date, total_counts, daily_temperature_2m_max) |>

slice_sample(n = 365, replace = TRUE) |>

arrange(date)

resample1 |> head(n = 30)We can fit the regression model using this single bootstrap resample — then obtain the parameter estimates and the overall model fit using tidy() and glance().

lm1_resample <- lm(total_counts ~ daily_temperature_2m_max, data = resample1)

lm1_resample |>

tidy() |>

select(term, estimate)lm1_resample |>

glance() |> select(r.squared, sigma)We can also create a scatterplot of the resampled data. Taken together, the paramater estimates and the plot are reasonably similar to what we found with the full sample estimated earlier.

lm1_resample |>

ggplot(mapping = aes(x = daily_temperature_2m_max, y = total_counts)) +

geom_point(color = "#8DD3C7", alpha = 0.5) +

theme_minimal() +

geom_smooth(method = "lm", se = FALSE, formula = y ~ x, color = "#8DD3C7") +

labs(title = "Temperature vs. daily bike ridership in NYC",

subtitle = "Bootstrap #1",

x = "Max temperature (°C)",

y = "Total riders recorded")Warning: `fortify(<lm>)` was deprecated in ggplot2 4.0.0.

ℹ Please use `broom::augment(<lm>)` instead.

ℹ The deprecated feature was likely used in the ggplot2 package.

Please report the issue at <https://github.com/tidyverse/ggplot2/issues>.

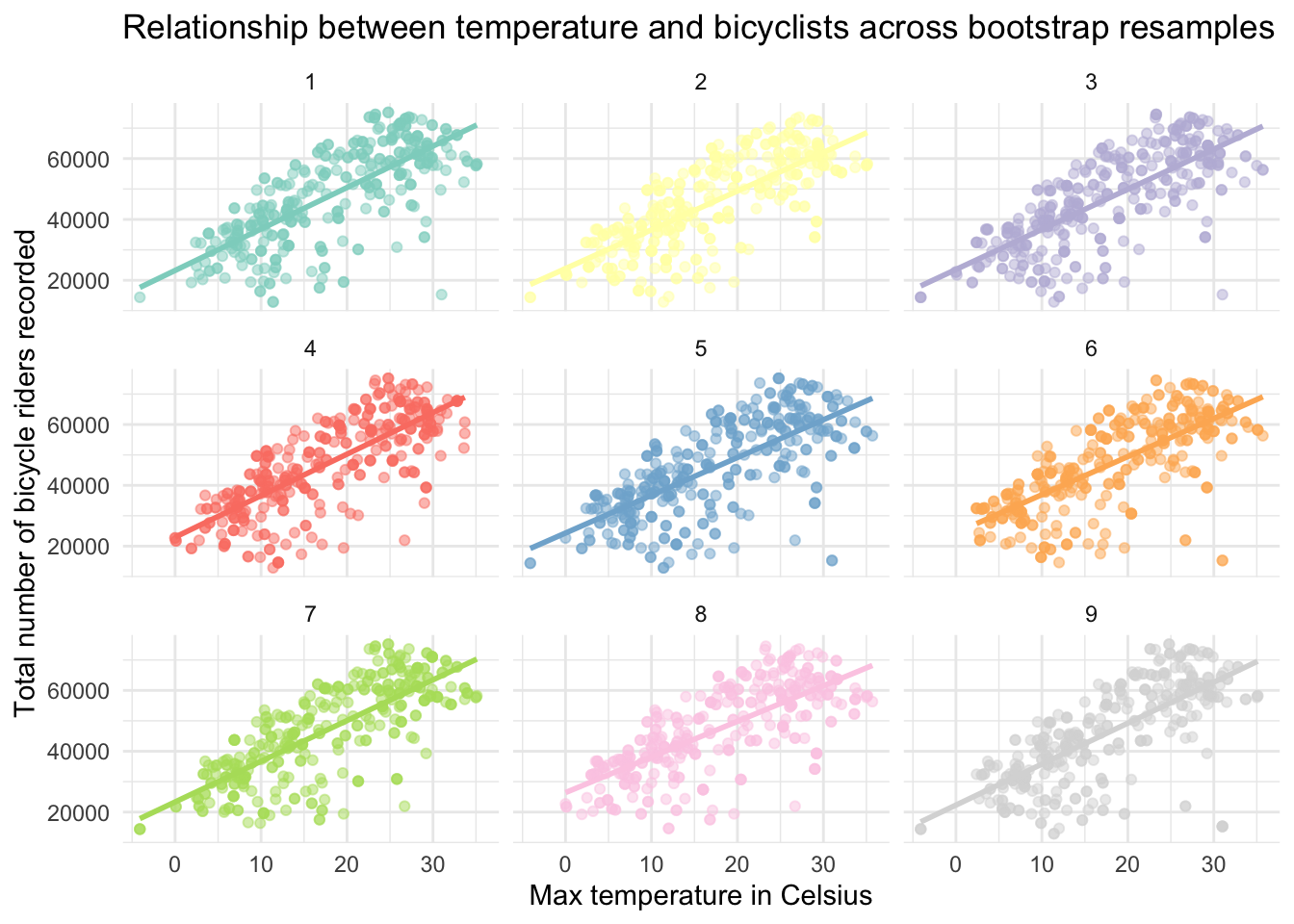

A collection of bootstrap resamples

Instead of creating one bootstrap resample — we can repeat the process multiple times. As an example, let’s look at the results for 9 bootstrap resamples. The table below presents the intercept, slope, \(R^2\), and sigma produced when the linear model is fit to each resample.

| Regression estimates for 9 bootstrap resamples | ||||

|---|---|---|---|---|

| resample | intercept | slope | r.squared | sigma |

| 1 | 23949.45 | 1307.152 | 0.5666796 | 9561.591 |

| 2 | 23403.70 | 1339.634 | 0.5543797 | 10333.302 |

| 3 | 23375.82 | 1352.952 | 0.5924992 | 9811.788 |

| 4 | 23653.76 | 1325.031 | 0.5802832 | 9957.217 |

| 5 | 26075.18 | 1189.872 | 0.5136135 | 10411.938 |

| 6 | 23273.36 | 1327.877 | 0.5412949 | 10533.370 |

| 7 | 23426.31 | 1315.231 | 0.5794856 | 9986.892 |

| 8 | 23205.02 | 1330.360 | 0.5945514 | 9449.718 |

| 9 | 25125.02 | 1237.323 | 0.5445161 | 10270.019 |

It is also informative to look at a scatterplot produced from each of the 9 bootstrap resamples.

In looking at the table of the 9 bootstrap resamples, we can see that the estimates of all parameters vary slightly, but are relatively similar. Likewise, the 9 scatterplots are each slightly different, as expected, but all show the same pattern — as temperature increases, more riders are recorded.

Rather than faceting by resample, we can put the best fit line for the 9 resamples on a single graph:

With just these 9 resamples, we can already get a sense of the variability from resample to resample — which helps us to visualize the uncertainty in our regression parameter estimates. For example, on the graph above we can see clearly see the variability in:

The intercept of each line (the predicted number of riders when temperature = 0), as well as

The effect of temperature on riders as illustrated by the varying slopes of the best fit lines.

Sufficient bootstrap resamples to simulate the sampling distribution

Recall from Module 9 that reliable estimates of bootstrapped parameters requires many more than just a few resamples. For example, many thousand resamples are typically used. Let’s take a look at a function that will repeat the process of creating bootstrap resamples, so that we can create 5000 resamples, fit the regression model in each resample, and then summarize across the resamples to quantify uncertainty.

# Create a function to carry out the bootstrap resampling and fit model

bootstrap_lm <- function(data) {

size <- nrow(data)

resample <- data |>

slice_sample(n = size, replace = TRUE) |>

arrange(date)

lm_model <- lm(total_counts ~ daily_temperature_2m_max, data = resample)

tidy_model <- tidy(lm_model)

glance_model <- glance(lm_model)

return(list(tidy = tidy_model, glance = glance_model))

}

# Perform the bootstrap resampling and model fitting using the bootstrap_lm() function

set.seed(12345) # For reproducibility

bootstrap_results <- map(1:5000, ~bootstrap_lm(nyc_bikes_2023))

# Extract and preparing the data for graphing and summary

model_summaries <-

map2(bootstrap_results, 1:5000, ~mutate(.x$glance, resample = .y)) |>

bind_rows() |> # takes 5000 outputs and combines them into one larger data frame.

select(resample, r.squared, sigma) |>

pivot_longer(-resample, names_to = "term", values_to = "estimate")

# Work now with the regression parameter estimates from tidy()

coefficients <-

map2(bootstrap_results, 1:5000, ~mutate(.x$tidy, resample = .y)) |>

bind_rows() |>

select(resample, term, estimate)

# Create one data frame that combines all estimates

bootstrap_distributions <-

bind_rows(coefficients, model_summaries) |>

arrange(resample)

# Calculate the summary statistics for intercept, slope, r-squared, and sigma

bootstrap_summary <-

bootstrap_distributions |>

filter(term %in% c("(Intercept)", "daily_temperature_2m_max", "r.squared", "sigma")) |>

group_by(term) |>

summarise(mean_estimate = mean(estimate),

sd_estimate = sd(estimate))Detailed code explanation for the curious

I don’t expect you to understand every bit of this now — but, if you’re interested in a detailed code explanation, please read the summary below.

Libraries

- purrr: This package it used for its functional programming tools, particularly map() functions to apply operations across elements in a list or vector.

Bootstrap Function

A custom function bootstrap_lm() is defined to perform bootstrap resampling and fit a linear regression model to each resample. This function:

Calculates the sample size of the provided data fame.

Performs resampling with replacement, maintaining the data frame size but allowing for repeated observations, to mimic drawing from the population.

Fits a linear regression model (called lm_model) to the resampled data, predicting total_counts from daily_temperature_2m_max.

Extracts and returns detailed model summaries (tidy_model for coefficients and glance_model for overall model metrics) in a list.

Bootstrap Resampling Execution

The bootstrap_lm() function is executed 5000 times using map(), each time on the nyc_bikes_2023 data frame, to generate a wide array of model fits. This simulates drawing from the underlying population distribution to assess the variability in model estimates.

set.seed(12345)ensures reproducibility of the results by setting a fixed starting point for random number generation used in resampling. This isn’t necessary unless you need to reproduce the exact same estimates from the random process.

Data Extraction and Preparation

The script extracts model summaries and coefficients from each bootstrap resample.

Model Summaries: Extracts the model summary values and does some reformatting to facilitate merging with coefficients later.

Coefficients: Similar extraction process for regression coefficients (intercept and slope), including the resample identifier.

Combining Estimates

- Merges the coefficients and model summaries into a single data frame, bootstrap_distributions, arranging them by resample identifier. This unified structure facilitates subsequent analysis.

Summary Statistics

- Calculates mean and standard deviation for each parameter estimate across all bootstrap resamples, summarizing the estimated distribution for relevant statistics and stores this information in a data frame called bootstrap_summary.

The output from this process is a table that presents the mean and standard deviation of each parameter estimate (i.e., intercept and slopes), the \(R^2\), and sigma (i.e., \(\sigma\)).

The values under mean_estimate in the table below are simply the average estimate across the 5000 bootstrap resamples.

The values under sd_estimate are the standard deviations of each estimate across the 5000 bootstrap resamples. The mutate() function in the code below rounds the numbers to the nearest thousandth for easier viewing.

bootstrap_summary |>

mutate(across(where(is.numeric), ~format(round(.x, digits = 3), scientific = FALSE)))Since the bootstrap resampling is mimicking the sampling distribution, and the standard deviation of the sampling distribution is the standard error — then this summary provides the quantification of uncertainty that we seek. The sd_estimate values quantify the variability of each parameter across the 5000 bootstrap resamples. As usual larger standard errors indicate more sample-to-sample variability, while smaller standard errors indicate less sample-to sample variability.

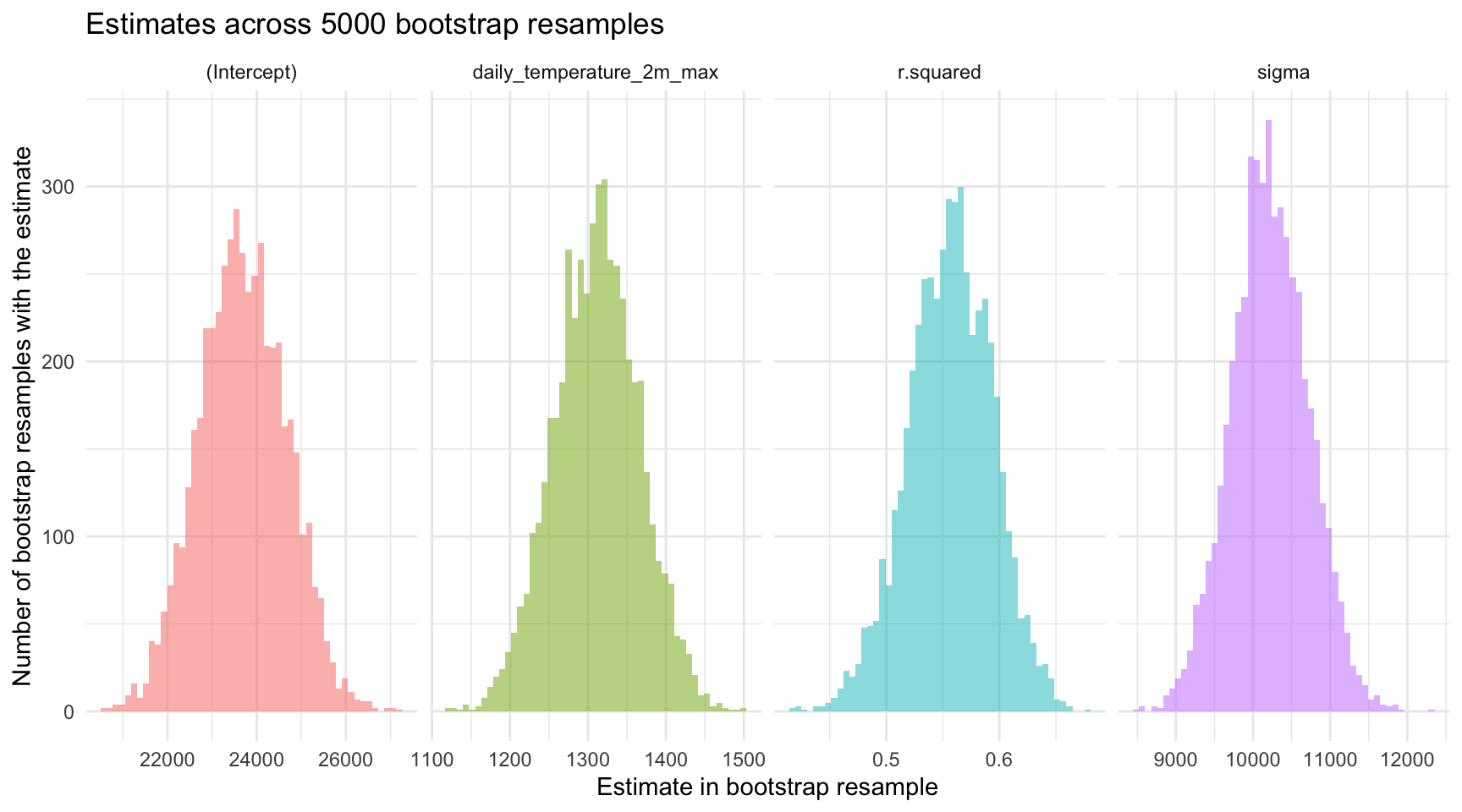

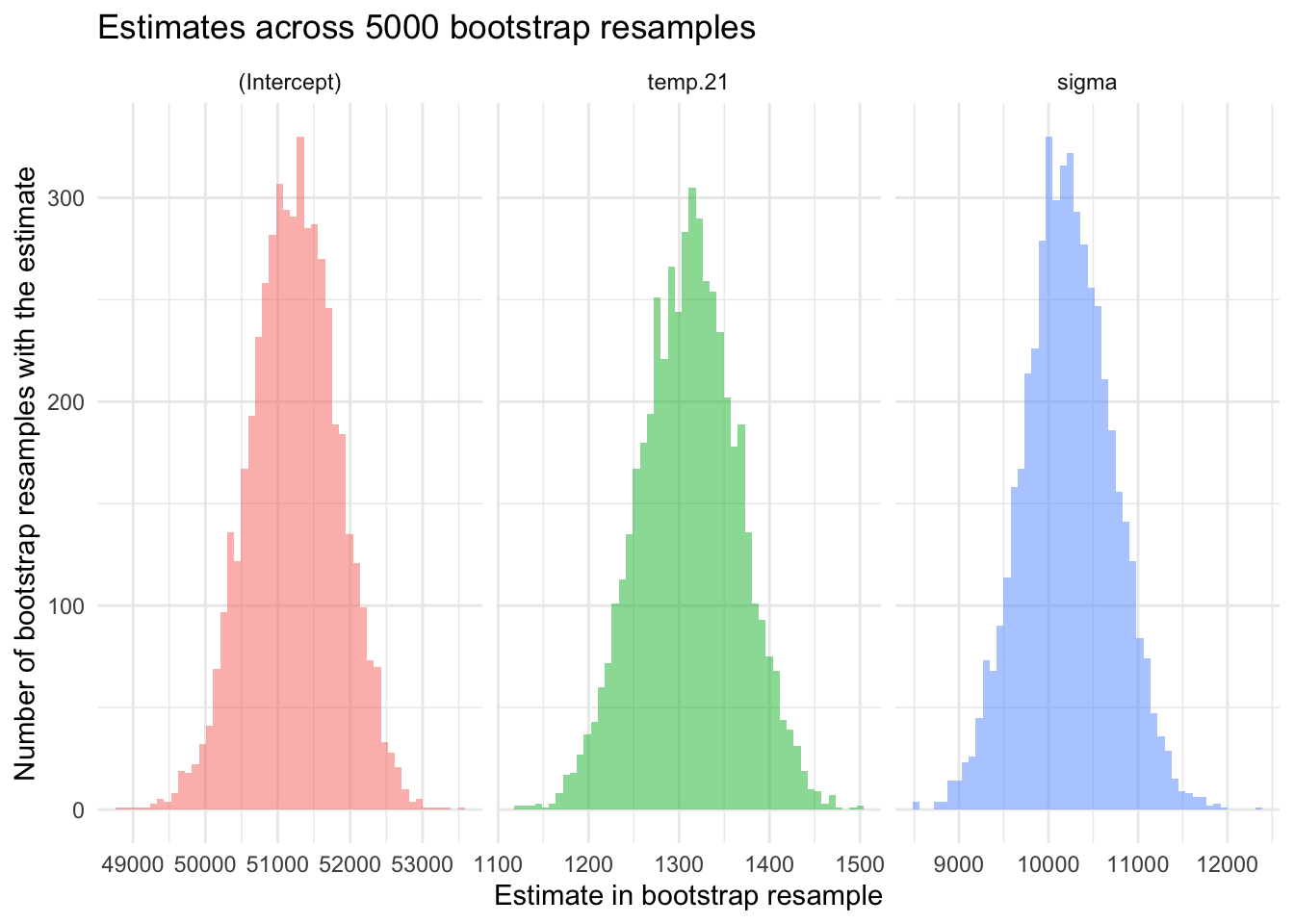

We can create a histogram of the estimates of the intercept, slope, sigma, and r.squared across our bootstrap resamples to visualize this variability. These estimates are stored in the file we created in the last code chunk — called bootstrap_distributions. In this file, the estimates of the intercept, slope (for daily_temperature_2m_max), r.squared, and sigma are recorded for all 5000 bootstrap resamples, indexed by resample number, as illustrated in the table below. That is, for each resample, there are four rows of data — one for each of the four parameter estimates of interest.

bootstrap_distributions |>

select(resample, term, estimate) |>

mutate(across(where(is.numeric), ~format(round(.x, digits = 3), scientific = FALSE))) |>

head(n = 30) To visualize the variability in these estimates across the bootstrap resamples, we can create a set of histograms.

bootstrap_distributions |>

select(term, estimate) |>

filter(term %in% c("(Intercept)", "daily_temperature_2m_max", "r.squared", "sigma")) |>

ggplot(mapping = aes(x = estimate, fill = term)) +

geom_histogram(bins = 50, alpha = 0.5) +

facet_wrap(~term, ncol = 4, scales = "free_x") +

theme_minimal() +

labs(x = "Estimate in bootstrap resample",

y = "Number of bootstrap resamples with the estimate",

title = "Estimates across 5000 bootstrap resamples") +

theme(legend.position = "none")

Please take a moment to study the histograms to note the approximate minimum and maximum values for the estimates, as well as the placement of the peak (i.e., the most common value).

Using estimates from each bootstrap resample, we may also plot the corresponding fitted regression lines to visually assess the variability of our model’s predictions. This visualization is achieved with the geom_abline() function, a ggplot2 function that draws straight lines specified by an intercept and slope. In our case, we’re using the intercept and slope produced by each bootstrap resample to draw the implied line — and then plot all 5000 implied lines on one graph.

# Calculate means for each term

means <- bootstrap_distributions |>

group_by(term) |>

summarise(mean_estimate = mean(estimate))

mean_int <-

means |>

filter(term == "(Intercept)") |>

pull(mean_estimate)

mean_slope <-

means |>

filter(term == "daily_temperature_2m_max") |>

pull(mean_estimate)

# Reshape the data frame to have intercepts and slopes on the same row for each bootstrap sample

bootstrap_line <-

bootstrap_distributions |>

filter(term %in% c("(Intercept)", "daily_temperature_2m_max")) |>

select(term, estimate) |>

mutate(sample_id = rep(1:(n()/2), each = 2)) |> # Create an ID for each pair of intercept and slope

pivot_wider(id_cols = sample_id, names_from = term, values_from = estimate)

# Now plot using geom_abline

nyc_bikes_2023 |>

ggplot(mapping = aes(x = daily_temperature_2m_max, y = total_counts)) +

geom_point(alpha = 0.3, color = "lightgrey") +

geom_abline(data = bootstrap_line, aes(intercept = `(Intercept)`, slope = daily_temperature_2m_max), color = "darkgrey") +

geom_abline(intercept = mean_int, slope = mean_slope, color = "black") +

scale_color_manual(values = colors) + # Apply the defined color palette

theme_minimal() +

labs(title = "Temperature vs. daily bike ridership in NYC",

subtitle = "Best fit line for 5000 bootstrap resamples",

x = "Max temperature (°C)",

y = "Total riders recorded") +

guides(color = "none")

Due to the high number of resamples (5000), these lines collectively resemble a thick confidence band, effectively illustrating the range of plausible regression lines given the sampling variability. Additionally, a prominent black line represents the regression line defined by the mean intercept and slope calculated across all bootstrap resamples. This average line serves as a central tendency marker amidst the bootstrap lines, highlighting the overall direction and strength of the relationship modeled in the resampling process.

It’s also interesting to use the graph above to examine the span of the predicted scores (predicted bike count) at any given temperature. For example, for cold days (e.g., -5°C) and very hot days (35°C), the vertical distance between the largest and smallest predicted score is large — but for average days (e.g., around 15°C), the vertical distance between the largest and smallest predicted score is smaller. This indicates that we have more precision to predict the outcome when the predictor is toward the average score in the sample, and less precision as we move toward the tails of the distribution of the predictor. This is an important characteristic of all fitted regression models.

Confidence intervals for the parameter estimates

In addition to quantifying uncertainty in the estimates via the standard error, we may calculate confidence intervals based on the bootstrap resamples. Recall from Module 9 that we used the quantile() function to find the lower and upper bound of our desired confidence interval (CI) based on the distribution of the bootstrap estimates. Let’s calculate a 95% CI for the estimates using this percentile method applied to our bootstrap resamples.

95% CI for the intercept

bootstrap_distributions |>

filter(term == "(Intercept)") |>

summarize(lower = quantile(estimate, probs = 0.025),

upper = quantile(estimate, probs = 0.975))95% CI for the slope

bootstrap_distributions |>

filter(term == "daily_temperature_2m_max") |>

summarize(lower = quantile(estimate, probs = 0.025),

upper = quantile(estimate, probs = 0.975))95% CI for \(R^2\)

bootstrap_distributions |>

filter(term == "r.squared") |>

summarize(lower = quantile(estimate, probs = 0.025),

upper = quantile(estimate, probs = 0.975))95% CI for sigma

bootstrap_distributions |>

filter(term == "sigma") |>

summarize(lower = quantile(estimate, probs = 0.025),

upper = quantile(estimate, probs = 0.975))The calculated 95% CIs — based on 5000 bootstrap resamples — give us insight into the uncertainty of these estimates under a frequentist framework. The CIs imply that if we were to repeat our study numerous times, and estimate a 95% CI for each parameter estimate, we would expect 95% of those intervals to capture the true parameter in the population. Thus, we can think of these intervals as providing a range of plausible values.

Using the same information, we can add the CIs to the histograms of the sampling distributions plotted earlier. In the updated plot below, the mean across the bootstrap resamples is recorded as a solid line in the middle of the histogram, and the middle 95% of each distribution is marked with dashed vertical lines.

# Calculate 95% CI for each term

cis <-

bootstrap_distributions |>

group_by(term) |>

summarise(lower = quantile(estimate, probs = 0.025),

upper = quantile(estimate, probs = 0.975))

# Join means and CIs for easier plotting

means_cis <- left_join(means, cis, by = "term")

# Plotting

bootstrap_distributions |>

select(term, estimate) |>

ggplot(mapping = aes(x = estimate, fill = term)) +

geom_histogram(bins = 50, alpha = 0.5) +

geom_vline(data = means_cis, aes(xintercept = mean_estimate, color = term), linetype = "solid") +

geom_vline(data = means_cis, aes(xintercept = lower, color = term), linetype = "dashed") +

geom_vline(data = means_cis, aes(xintercept = upper, color = term), linetype = "dashed") +

facet_wrap(~term, ncol = 4, scales = "free_x") + # Adjusted ncol to 2 for better layout

theme_minimal() +

labs(x = "Bootstrap distributions of regression coefficients for NYC bicycling model",

y = "Number of bootstrap resamples with the estimate",

title = "Estimates across 5000 bootstrap resamples",

subtitle = "Solid line represents the mean, dashed lines represent the middle 95% CI for each distribution") +

theme(legend.position = "none")

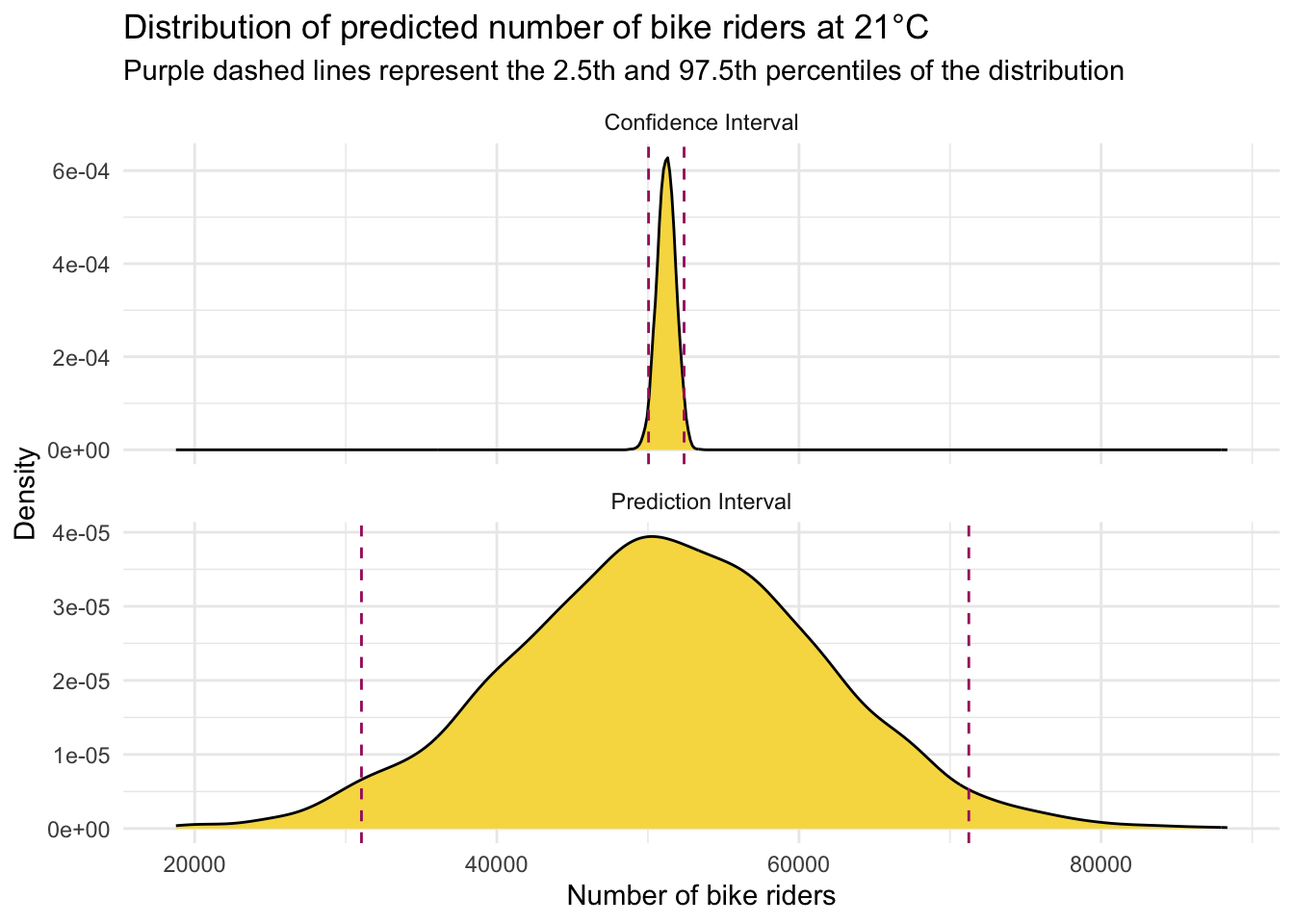

Confidence intervals for model predictions

When we use our simple linear regression model to predict the number of bicyclists on a day with a maximum temperature of 21°C, we get a point estimate — for example, 51,229 riders. But no prediction is exact. What we need to know is: How certain are we about that number?

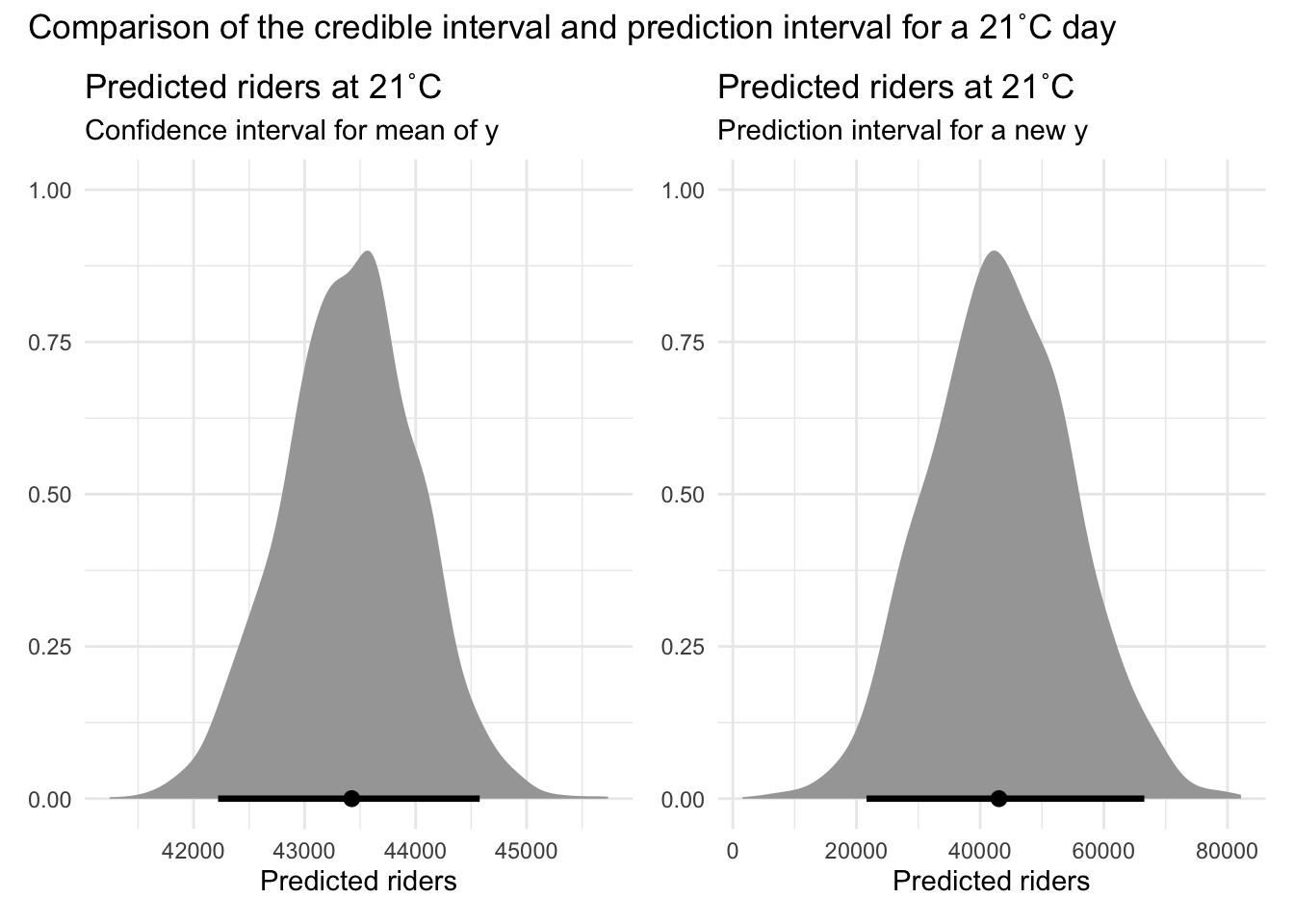

That’s where confidence intervals for model predictions come in. They give us a range of plausible values for predicted scores based on our model, helping us understand the uncertainty around our prediction. Importantly, there are two types of intervals, depending on what question we want to have answered:

Uncertainty Around the Average Outcome:

- What it tells you: Where the average number of riders is likely to fall on days with this temperature.

- Why it matters: Helps answer questions like, “What is the typical number of riders we can expect on a 21°C day?”

- What it’s called: This is a confidence interval (CI) for the predicted mean.

- Use case: Great for long-term planning and estimating trends.

Uncertainty Around Individual Predictions:

- What it tells you: Where the actual number of riders might fall on any given 21°C day.

- Why it matters: Helps answer questions like, “What could the rider count be on one particular day with this temperature?”

- What it’s called: This is a prediction interval (PI) for an individual value.

- Use case: Useful when preparing for a specific day — like planning safety measures for an event.

By distinguishing between these uncertainties, we can better understand both the variability in average predictions and the variability of individual predictions. Confidence intervals tell us where the average ridership for 21°C days likely falls, while prediction intervals show the range we’d expect for a single 21°C day.

Let’s take a look how we can calculate these two types of intervals for a predicted outcome.

First, we need to calculate the predicted scores for each bootstrap resample where daily_temperature_2m_max equals 21. We’ll call this new variable yhat.

predicted_scores <-

bootstrap_distributions |>

filter(term %in% c("(Intercept)", "daily_temperature_2m_max", "sigma")) |>

pivot_wider(names_from = term, values_from = estimate) |>

mutate(yhat = `(Intercept)` + daily_temperature_2m_max * 21)

predicted_scores |> head()Next, we calculate the CI and PI for the predicted score.

95% CI for mean of y when x = 21

Calculating the CI is very simple, and mimics the CI for the intercept in our fitted model. In fact, if you centered the daily_temperature_2m_max at 21 and refit the bootstraps using the centered version of temperature, the 95% CI for the new intercept would be equal to the 95% CI that we’ll calculate below.

# Calculate the 95% CI for the predicted scores

predicted_scores |>

select(yhat) |>

summarize(lower = quantile(yhat, probs = 0.025),

upper = quantile(yhat, probs = 0.975))The 95% CI for the mean number of bicycle riders at 21°C, ranging from 50,043 to 52,395, provides a range of plausible values for the average outcome based on our linear regression model.

In practice, we can interpret this as follows:

“Based on our model and bootstrap resampling, we are 95% confident that the true average daily ridership on 21 °C days lies between 50,043 and 52,395 cyclists.”

This interval refers to the mean over many 21 °C days, not to the count on any single day (which can vary much more).

95% PI for a new y when x = 21

Calculating the PI involves accounting for both the uncertainty in the estimated mean and the individual variability around that mean. Essentially, the PI provides a range of plausible values for individual predicted outcomes, considering both model uncertainty and the inherent individual variability in the data.

The process for computing a PI is a bit more involved, as demonstrated in the code below. To the predicted scores, we add a unique random value based on the standard deviation (sigma) for that specific bootstrap resample (thus the use of rowwise()), reflecting the individual variability. That is, the syntax mutate(adjusted_yhat = yhat + rnorm(1, mean = 0, sd = sigma)) adds a random value (drawn from a normal distribution with a mean of 0 and a standard deviation of sigma) to each predicted score (yhat). This accounts for the individual variability in predictions.

set.seed(123) # For reproducibility

# Add a residual to yhat to account for individual variability

adjusted_predictions <-

predicted_scores |>

rowwise() |>

mutate(adjusted_yhat = yhat + rnorm(1, mean = 0, sd = sigma)) |>

ungroup()

# Calculate the 95% CI for the predicted scores

adjusted_predictions |>

select(adjusted_yhat) |>

summarize(lower = quantile(adjusted_yhat, probs = 0.025),

upper = quantile(adjusted_yhat, probs = 0.975))The 95% PI for the number of bicycle riders at 21°C, ranging from 31,041 to 71,240, provides a range of plausible values for predicted number of riders on a specific day.

In practice, we can interpret this as follows:

Based on our model and bootstrap resampling, we are 95% confident that an individual 21 °C day would see ridership somewhere between 31,041 and 71,240 cyclists.

Unlike the confidence interval (which targets the average over many such days), this 95% prediction interval captures both:

Model (estimation) uncertainty – we don’t know the true regression line exactly; and

Day-to-day residual variability – even if we did know the line, any single day can sit well above or below it.

Hence the prediction interval is much wider, reflecting the full range of plausible outcomes for one future day at 21 °C.

Why the distinction between a CI and PI for a predicted score matters.

Imagine you’re a city planner:

If you’re planning long-term budgets for bike lane maintenance, you care about the average number of riders. Use the CI — e.g., “We expect an average of 18,000 to 22,000 riders per day at this temperature.”

But if you’re planning for a specific event day (like a parade or festival), you care about how high or low the number could realistically be. Use the PI — e.g., “We might see anywhere from 15,000 to 25,000 riders, depending on the day.”

Plotting the CI and PI

Take a look at the graph below which contrasts the CI and the PI.

We can clearly see here that when estimating the number of bicycles recorded on a 21°C day in NYC, our estimates exhibit different levels of precision depending on whether we are predicting the average number of riders (for CI) or the number of riders on a specific day (for PI). The CI for the mean prediction is much narrower compared to the PI for an individual prediction. This distinction highlights a key concept in statistical modeling.

This should be intuitive: estimating the average number of riders across many days is inherently more precise than predicting the number of riders on any single day. The average smooths out the day-to-day fluctuations and anomalies, leading to a more stable estimate, whereas individual days can vary significantly due to numerous unpredictable factors such as weather fluctuations, special events, or random variations in daily commuting patterns.

Theory-based (i.e., parametric) estimation of standard errors and CIs

Besides bootstrapping, we can obtain standard errors and confidence intervals for the regression intercept and slope directly from closed-form formulas — that is, exact mathematical equations that give a result in a single step without needing iterative procedures or simulations.

These formulas work when the classical linear-model assumptions are met:

The errors are independent and have constant variance1.

The errors (the unobserved deviations from the true regression line) are assumed to be either (a) normally distributed, or (b) from some other distribution with finite variance, where in large samples, the Central Limit Theorem ensures the sampling distribution of the coefficient estimates is approximately normal.

Under those conditions the recipe is:

- Fit the model and record the residual mean-square; this is our estimate of the error variance, \(\hat\sigma^{2}\).

- Compute the standard error for each coefficient (your software does the algebra).

- Build a \((1-\alpha)\,\)% confidence interval with

\(\hat\beta_j \; \pm \; t_{\alpha/2,\; df}\,\text{SE}(\hat\beta_j)\),

where \(t_{\alpha/2,\; df}\) is the critical value from the \(t\) distribution and

\(df = n - p - 1\) (sample size minus number of predictors minus the intercept).

In short, when the assumptions hold these formulas give you instant uncertainty estimates — no resampling required.

SE for intercept and slope

In SLR, the precision of the estimated intercept (\(b_0\)) and slope (\(b_1\)) is quantified by their standard errors (SEs). These standard errors reflect how much the estimates would vary from sample to sample.

The standard error of the slope, \(SE_{b_1}\), is calculated using the formula:

\[ SE_{b_1} = \sqrt{ \frac{ \text{SSE} / (n - 2) }{ \sum_{i=1}^{n} (x_i - \bar{x})^2 } } \]

where:

- \(SSE = \sum_{i=1}^{n} (y_i - \hat{y}_i)^2\) is the residual sum of squares,

- \(n\) is the sample size,

- \(x_i\) are the values of the predictor variable, and

- \(\bar{x}\) is the mean of the predictor variable.

The standard error of the intercept, \(SE_{b_0}\), is given by:

\[ SE_{b_0} = \sqrt{ \left( \frac{1}{n} + \frac{\bar{x}^2}{\sum_{i=1}^{n} (x_i - \bar{x})^2} \right) \cdot \frac{ \text{SSE} }{ n - 2 } } \]

This formula incorporates both the residual variability (how much the actual \(y_i\) values deviate from the regression line) and the variability in the predictor \(x\).

The term

\[

\left( \frac{1}{n} + \frac{\bar{x}^2}{\sum (x_i - \bar{x})^2} \right)

\]

reflects how far the predictor’s mean \(\bar{x}\) is from zero. The further \(\bar{x}\) is from 0, the larger this quantity becomes, increasing the standard error of the intercept.

This means the precision of the intercept estimate depends on where the predictor is centered: when \(\bar{x}\) is near 0 (i.e., the predictor is centered), the standard error of the intercept is smaller; when \(\bar{x}\) is far from 0, the standard error is larger.

The standard errors provide a measure of the variability or uncertainty around our estimated regression parameters. Recall that these SEs are estimates of the standard deviation of the sampling distribution for each respective parameter. For example:

Standard Error of the Slope (\(SE_{b_1}\)): This measures the variability of the estimated slope (which represents the change in the outcome variable for a one-unit change in the predictor variable) across many random samples drawn from the population. Essentially, it tells us how much the estimated slope is expected to fluctuate due to random sampling variability, with a smaller value implying greater reliability of the slope estimate.

Standard Error of the Intercept (\(SE_{b_0}\)): This measures the variability of the estimated intercept (which represents the expected value of the outcome variable when the predictor variable is zero) across many random samples drawn from the population. Essentially, it tells us how much the estimated intercept is expected to fluctuate due to random sampling variability, with a smaller value implying greater reliability of the intercept estimate.

In practice, statistical software like R simplifies these calculations for us. To see the standard errors for the intercept and slope, we just add std.error to the list of terms produced by tidy() that we’d like to display.

slr <- lm(total_counts ~ daily_temperature_2m_max, data = nyc_bikes_2023)

slr |> tidy() |> select(term, estimate, std.error)The values listed under std.error provide the estimated standard errors for \(SE_{b_0}\) and \(SE_{b_1}\), denoting the precision with which we can estimate the intercept and slope of the regression model. These standard errors are crucial for constructing confidence intervals and conducting hypothesis tests about the regression parameters (which we will tackle in Module 16), helping us understand and quantify the uncertainty in our estimates.

Confidence intervals for the parameter estimates

To calculate CIs for the intercept and slope(s) using a theory-based (i.e., parametric approach), we take the estimate plus the critical values of t times the standard error (std.error). Recall from Module 09 that to calculate the appropriate critical value of t, we need the degrees of freedom (df) for the model.

For a regression model, the appropriate df for computing the critical values of t for the intercept and the slope(s) is calculated as n - 1 - p, where n is the sample size, and p is the number of predictors (we lose one df for estimating the intercept and an additional df for estimating the effect of each predictor).

Since we only have 1 predictor in this regression model, the correct df is 365 - 1 - 1 = 363.

Thus, if we desire to calculate a 95% CI, the appropriate critical values of t are:

qt(c(0.025, 0.975), df = 363)[1] -1.966521 1.966521Plugging in the parameter estimates, standard error, and critical value of t, we can compute each CI:

95% CI for the intercept:

\[ CI = b_0 \pm t_{n-2, \alpha/2} \times SE_{b_0} \]

\[ 95\% \text{ CI } = 23711.546 \pm (1.967\times1212.994) \]

95% CI for the slope:

\[ CI = b_1 \pm t_{n-2, \alpha/2} \times SE_{b_1} \]

\[ 95\% \text{ CI } = 1310.377 \pm (1.967\times61.511) \]

CI’s with tidy()

There’s no need to calculate confidence intervals by hand — the tidy() function can do it for us. By setting conf.int = TRUE, we can extract confidence intervals for each model coefficient directly from the output for whatever confidence level we desire:

slr |>

tidy(conf.int = TRUE, conf.level = 0.95) |>

select(term, estimate, std.error, conf.low, conf.high)What do the CIs capture in this context?

In the long run, if we were to repeatedly draw new samples and calculate a 95% confidence interval from each, about 95% of those intervals would contain the true population slope.

For our study, the 95% CI for the effect of temperature on the number of bicycle riders is approximately 1189 to 1431. This means that, based on our sample, we can say we are 95% confident that the true slope — the expected increase in riders for each 1°C rise in temperature — lies between 1189 and 1431.

On the other hand, the 95% CI for the intercept ranges from about 21,326 to 26,097. With 95% confidence, we can say that the average number of riders on a day with a maximum temperature of 0°C falls between those values.

Confidence band for regression line

Let’s recreate the scatterplot with the best fit line overlaid, but now we will request standard errors (se = TRUE within the geom_smooth() function call). The shaded area in the figure below provides an assessment of the precision of our estimated best fit line. Though our single sample provides an intercept and slope for the best fit line in the sample (the thick black line), the shaded grey area provides a range of plausible areas where the best fit line in the population may fall. The default is a 95% confidence band — but this can be modified with the addition of an argument to geom_smooth() — namely by adding level = 0.99 after se = TRUE. In this way, our regression model provides us with the best fit line in our sample, but also provides us with an understanding of the precision of our estimates and how much we can expect them to vary from sample-to-sample.

nyc_bikes_2023 |>

ggplot(mapping = aes(x = daily_temperature_2m_max, y = total_counts)) +

geom_point() +

geom_smooth(method = "lm", se = TRUE, formula = y ~ x, color = "black") +

theme_minimal() +

labs(title = "Scatterplot of max daily temperature and bicycle riders with best fit line",

subtitle = "Confidence interval for regression line in gray shaded area",

x = "Max temperature (°C)",

y = "Total riders recorded")

Confidence intervals for model predictions

Earlier we used the predict() function to calculate the predicted score for the outcome at a certain value of \(x_i\) by using the following code:

# Creating a data frame with the desired predictor values

new_data <- data.frame(daily_temperature_2m_max = 21)

# Utilizing the linear model to predict outcomes based on new data

predicted_riders <- slr |> predict(newdata = new_data) 95% CI for mean of y when x = 21

We can augment the predict()2 function code to calculate a CI for the predicted count of bicycles when the temperature equals 21°C by specifying interval = "confidence":

slr |> predict(newdata = new_data, interval = "confidence", level = 0.95) fit lwr upr

1 51229.46 50099.72 52359.21The values under lwr and upr provide the lower and upper bound for the interval respectively.

95% PI for a new y when x = 21

We just need a simple change to the prior code for the CI to obtain a PI instead, namely, we need to change the interval type from "confidence" to "prediction":

slr |> predict(newdata = new_data, interval = "prediction", level = 0.95) fit lwr upr

1 51229.46 31021.89 71437.04Plotting the CI and PI

Let’s take a look at one last visualization to further study the difference between a CI and a PI for a predicted score. Error bar plots are a powerful visual tool designed to express this uncertainty, providing a clear representation of the precision and reliability of statistical estimates. Error bar plots are graphical representations that utilize points to signify central estimates, like means or predicted values, and bars, known as “error bars,” to span a range that reflects variability or uncertainty. These bars can depict different statistical measures of dispersion, such as standard deviations, standard errors, or more specifically for our discussion, CIs and PIs.

# Create a data frame with the point estimates and the CI and PI when x = 21

results <- data.frame(

type = c("CI", "PI"),

estimate = c(51229.46, 51229.46), # Assuming the same point estimate for both CI and PI

lower = c(50099.72, 31021.89), # CI lower bound, PI lower bound

upper = c(52359.21, 71437.04) # CI upper bound, PI upper bound

)

# Create the ggplot

results |>

ggplot(mapping = aes(x = type, y = estimate, ymin = lower, ymax = upper)) +

geom_errorbar(width = 0.05, color = "skyblue3") +

geom_point(size = 2, color = "skyblue4") +

scale_x_discrete(labels = c("CI" = "Confidence Interval", "PI" = "Prediction Interval")) +

labs(title = "Error bar plot for predicted riders at 21°C",

x = "", y = "Predicted number of riders") +

theme_minimal()

The plot distinctly illustrates that estimating a 95% CI for the average number of riders on days with a maximum temperature of 21°C is relatively precise. This precision is evident in the narrow range of the CI, indicating a high level of confidence in where the true average likely falls. In contrast, the 95% PI, which forecasts the expected range of riders for any single day at 21°C, exhibits significantly less precision. The broader span of the PI underscores the inherent variability in daily rider counts, reflecting both the uncertainty in estimating the mean and the natural fluctuation of individual observations around that mean.

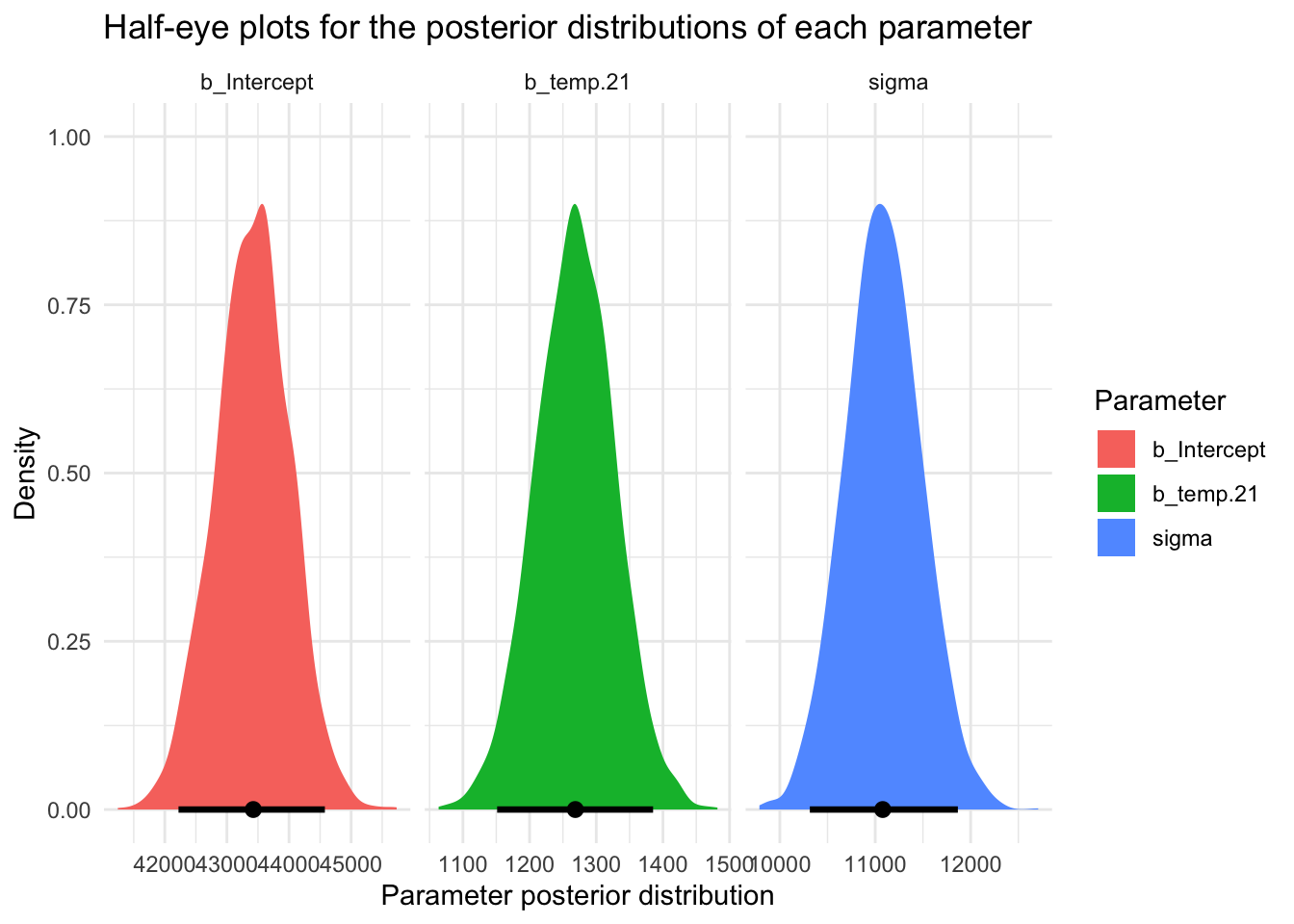

Bayesian approach to quantification of uncertainty

In Module 09 we studied a Bayesian approach to estimating and visualizing uncertainty for descriptive statistics (i.e., a proportion and a mean). In this section, we’ll use the same machinery to estimate and visualize uncertainty for linear regression parameter estimates.

In Bayesian regression, the approach to understanding population parameters — including the intercept (\(\beta_0\)), the slope (\(\beta_1\)), and sigma (\(\sigma\)) — fundamentally diverges from the frequentist perspective. Rather than treating these parameters as fixed yet unknown quantities that we aim to estimate directly from the sample data, the Bayesian method views them as random variables endowed with their own probability distributions. This shift in perspective enables the incorporation of existing knowledge or beliefs into the analysis through the specification of prior distributions.

A new data frame to apply a Bayesian framework

In this section, we will continue to explore the relationship between temperature (daily_temperature_2m_max) and the number of bicycle riders (total_counts) in NYC on a particular day. Instead of refitting the model using the 2023 data, we will leverage our knowledge from the 2023 data as prior information. This prior information will be used to examine the relationship between temperature (daily_temperature_2m_max) and the number of bicycle riders (total_counts) for the 2020 data.

The data frame, which includes all of the same variables as in the 2023 data frame, is hosted in a file called nyc_bikes_2020.Rds. Let’s begin by importing the data.

nyc_bikes_2020 <- read_rds(here("data", "nyc_bikes_2020.Rds"))

nyc_bikes_2020 |> head()When conducting Bayesian model building, it’s best to go step-by-step:

Identify the Nature of \(Y\): The first step involves discerning whether the outcome variable is discrete or continuous. This distinction guides us in selecting the most appropriate model structure for the data. In our example, we’ll use a Normal/Gaussian distribution for modeling the number of bicycle riders.

Modeling the Outcome: We express the mean of the \(y_i\) scores as a function of the predictor(s) (e.g., \(\hat{y} = b_0 + b_1 x_i\) for a SLR).

Identifying Unknown Parameters: Every model comes with parameters that need to be estimated — such as the intercept (\(\beta_0\)), slope (\(\beta_1\)), and the standard deviation of the residuals (sigma — that is, \(\sigma\)). Identifying these parameters is key for model formulation. Each of the parameters are hyperparameters (i.e., a hyperparameter is a parameter of a prior distribution) that can be adjusted based on prior knowledge or beliefs.

Choosing Prior Distributions: The essence of Bayesian modeling lies in selecting prior distributions for these unknown parameters. For the intercept (\(\beta_0\)) and slope (\(\beta_1\)), which can span the entire real line, Normal distributions serve as intuitive choices given their flexibility. Choosing a prior distribution for \(\sigma\) can be more challenging. \(\sigma\) represents a standard deviation and cannot be negative, so we want to exclude the possibility of negative values in our prior information.

Defining the priors

In the first part of this Module, we studied the linear model that relates temperature to the count of bike riders in NYC based on the 2023 data. We will make use of the bootstrap distributions of the model parameters derived from the 2023 data to specify the priors for the 2020 data.

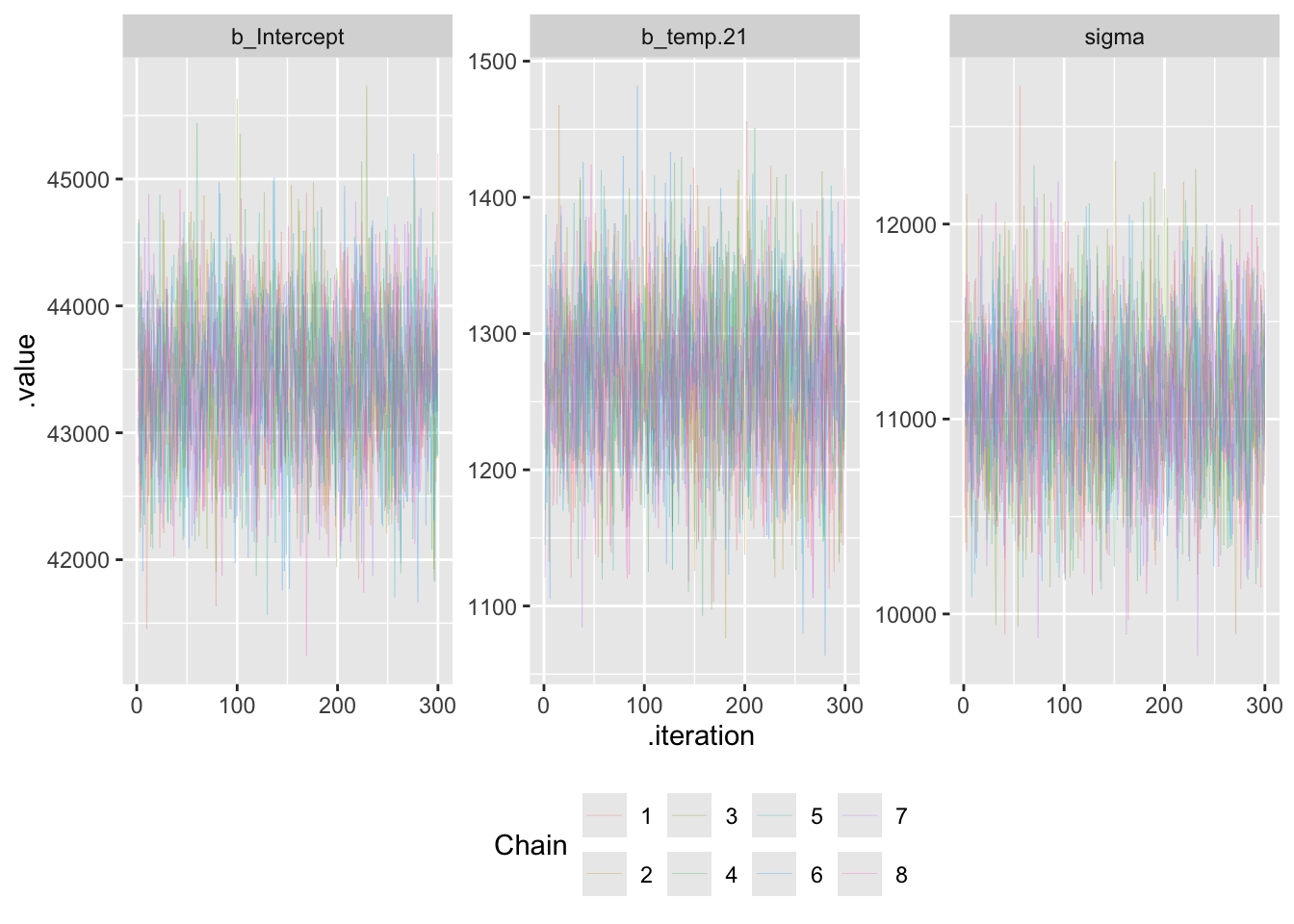

As described in Module 09, Bayesian models use Markov Chain Monte Carlo (MCMC) algorithms to estimate the parameters of the model, and for this type of estimation, it’s recommended to center the predictor(s) toward the middle of the data so the intercept of the regression model has a good deal of data available to estimate the parameter. This can help convergence of the models.

Therefore, instead of using the temperature variable expressed in it’s natural metric (where 0 represents 0°C), we’ll create a new version of the temperature variable — called temp.21 — which is centered at 21°C. This temperature, which equates to about 70°F, is more firmly in the middle of the distribution. I also picked this value since we explored this particular temperature earlier in the Module when calculating predicted bicycle counts based on the fitted model.

Since we’ll use the 2023 data as prior information, I refit the bootstrap models that we studied above using this centered version of temperature. The table below presents the the mean and standard deviation of the three parameters that we need to specify priors for — i.e., the intercept, the slope for temperature, and sigma, based on the centered version of temperature (temp.21) for the 2023 data. Because of the recentering of the predictor — the estimate and standard error for the intercept has shifted (as compared to our prior bootstrap results).

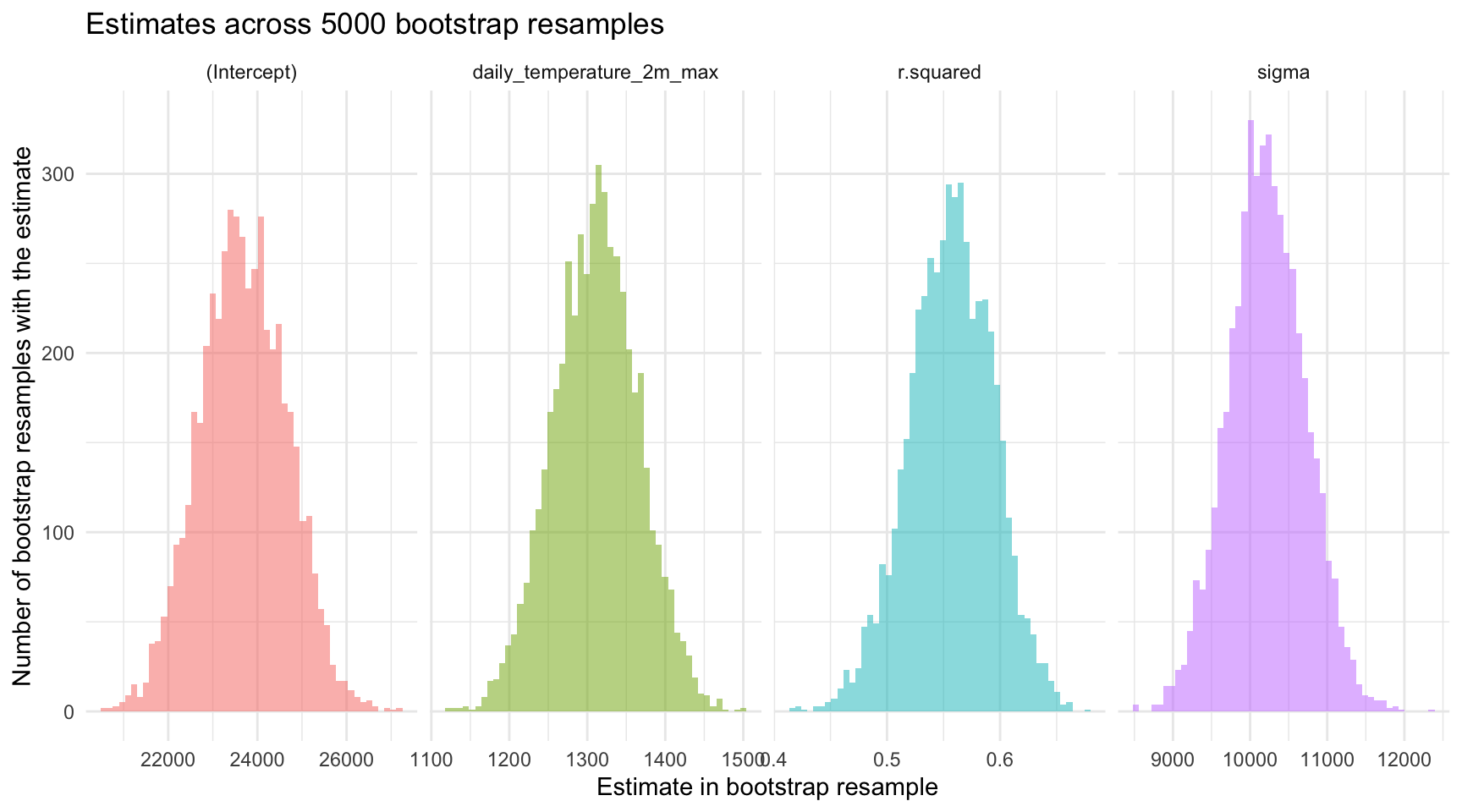

It’s also useful to visualize what the distribution of these parameters looks like across our bootstrap resamples using the 2023 data. The plots below show the distribution of each of the parameters across the 5000 bootstrap resamples.

Please take a moment to look at these — noting the middle of the distribution, as well as the minimum and maximum scores.

The mean, standard deviation, minimum, and maximum estimates derived from the bootstrap distributions of the 2023 data provide a foundation for specifying our priors for the 2020 data.

Based on the 2023 information, we could choose to set our priors for the 2020 data as follows:

Intercept (\(\beta_0\)) Prior: Given the nature of the intercept, a Normal distribution is an appropriate choice for the prior, set as \(\beta_0 \sim N(51224, 612)\) (i.e., the intercept is assumed to follow a Normal distribution with a mean of 51224 and a standard deviation of 612).

Slope (\(\beta_1\)) Prior: For \(\beta_1\), reflecting how much the outcome variable changes with a one-unit increase in the predictor, a Normal prior based on the bootstrap estimates is utilized: \(\beta_1 \sim N(1311, 55)\).

Residual Standard Deviation (\(\sigma\)) Prior: Specifying a prior for \(\sigma\) can be challenging because it represents a standard deviation (which is a bit less intuitive than the intercept and slope) and cannot be negative3. The bootstrap distributions for \(\sigma\) based on the 2023 data is relatively normal in our histogram. Thus, a Normal prior for \(\sigma\) based on the 2023 data is as follows: \(\sigma \sim N(10221, 500)\).

Bayesian modeling offers a way for scientists to formally incorporate expert knowledge into their analysis. While data from 2023 likely provide a strong foundation for understanding typical bike ridership patterns, we should be cautious when applying these patterns to earlier years like 2020. During 2020, COVID-19 lockdowns and shifts in public behavior likely altered biking habits in ways that differ from more recent, post-pandemic patterns.

As a result, while our priors based on 2023 data provide a strong empirical foundation, we could consider modifications that reflect potential differences expected in 2020. For instance, overall ridership levels might have been different (perhaps lower or higher) or exhibited different sensitivities to temperature due to reduced commuting or recreational activities during various phases of pandemic-related restrictions. Thus, in setting our priors, we could:

Widen the Prior Distributions: Adjusting the standard deviations of our Normal priors can offer greater flexibility, acknowledging the increased uncertainty and potential for variation in ridership patterns during 2020. This approach helps ensure our priors are informative yet not overly restrictive, allowing the 2020 data to significantly inform the posterior distributions.

Consider Prior Predictive Checks: Conducting prior predictive checks can be invaluable. This involves simulating data from our model using only the priors and examining whether these simulated data outcomes seem reasonable within the context of 2020. If the simulated outcomes are excessively unrealistic (e.g., predicting higher ridership than plausible during lock down periods), this signals a need to adjust the priors to better reflect the expected conditions of that year.

Embrace the Bayesian Philosophy: The essence of Bayesian analysis lies in its iterative process of updating beliefs with new evidence. By starting with priors informed by 2023 data but adjusted for the anticipated differences of 2020, we embrace a balanced approach. This allows the data from 2020 to “speak” more emphatically, particularly when it presents new patterns or trends not observed in the 2023 dataset. Our analysis, therefore, remains rooted in empirical knowledge while being receptive to the unique insights the 2020 data may reveal.

In summary, by thoughtfully calibrating our priors to account for the peculiarities of 2020 without making them overly constrictive, we enable a nuanced analysis that respects both our prior knowledge and the distinctiveness of the data at hand. This balanced approach underscores the Bayesian commitment to learning from data, ensuring that our model is both informed by past insights and adaptable to uncover new understandings.

Following the second recommendation above (Consider Prior Predictive Checks), we can check that the prior distributions that we’ve selected fit what we imagine for the 2020 data by using the following code, which allows for the visualization of the priors. The function plot_normal() is a function from the bayes_rules package — which is a companion package to the highly recommended Bayes’ Rules e-book.

see_prior_intercept <-

plot_normal(mean = 51224, sd = 612) +

theme_minimal() +

labs(x = "intercept", y = "probability density function")

see_prior_slope <-

plot_normal(mean = 1311, sd = 55) +

theme_minimal() +

labs(x = "slope", y = "probability density function")

see_prior_sigma <-

plot_normal(mean = 10221, sd = 500) +

theme_minimal() +

labs(x = "sigma", y = "probability density function")

library(patchwork)

p <- see_prior_intercept | see_prior_slope | see_prior_sigma

p + plot_annotation(title = "Implied density plots for specified priors")

These density plots show the implied probability distributions for each parameter estimate based on our 2023 data. We can check these to see if the priors appropriately capture the variability and range we expect for the 2020 data. For example, noting the center of the distribution and the spread of each distribution (e.g., the minimum and maximum scores for each parameter). This visualization helps us verify that our priors are reasonable and aligned with our empirical knowledge.

After looking at the implied probability distributions based on our initial ideas for the prior information, we can proceed as follows:

Interpret the Plots: Assess whether the peaks (modes) of the distributions are centered around the mean estimates. Check the spread of the distributions to ensure they encompass the variability seen in the 2023 data.

Adjust Priors if Necessary: If the density plots indicate that the priors are too narrow or too broad, adjust the standard deviations accordingly. Re-evaluate the choice of distribution (e.g., considering heavier-tailed distributions for sigma if needed).

Validate Assumptions: Cross-verify the empirical knowledge and assumptions underlying the priors. Ensure that any domain-specific insights are reflected in the chosen distributions.

By thoroughly examining these density plots based on our 2023 priors, we can ensure that our priors are not only informed by the empirical data from 2023 but also appropriately flexible to capture the variability and uncertainties expected in the 2020 data.

Going hand in hand with the inspection of the implied distributions for each parameter estimate based on our chosen priors, we can also simulate data based on our prior distribution specifications. This step allows us to verify that the priors capture the variability and range we expect for the 2020 data.

We can accomplish this type of simulation via the brms package. We specify the equation for the model we seek to estimate: formula = total_counts ~ temp.21). Additionally, for predictive checking we add the argument sample_prior = "only"4, which instructs the brm() function to sample exclusively from the prior distribution, ignoring the observed data. This is useful for visualizing and understanding the prior predictive distribution, which shows the range of outcomes that the priors alone would predict.

The code to carry out this task is in the code chunk below:

# Create centered version of temperature in the 2020 data frame

nyc_bikes_2020 <-

nyc_bikes_2020 |>

mutate(temp.21 = daily_temperature_2m_max - 21)

# Define our priors

priors <- c(

prior(normal(51224, 612), class = Intercept),

prior(normal(1311, 55), class = b, coef = 'temp.21'),

prior(normal(10221, 500), class = sigma)

)

# Visualize implied distributions

sim_based_on_priors <- brm(

formula = total_counts ~ temp.21,

data = nyc_bikes_2020,

family = gaussian(),

prior = priors,

sample_prior = "only",

chains = 4,

warmup = 5000,

iter = 20000,

)Once the data is simulated based on the priors, we can create plots to determine if the output seems reasonable. To do so we use the add_epred_draws() function from the tidybayes package. Let’s take a look at the code to obtain 100 estimates of the best fit line based on our priors, then break down how the code works.

draws_priors <- tibble(

temp.21 = seq(-21, 15)) |>

add_epred_draws(sim_based_on_priors, ndraws = 100)

draws_priors |>

ggplot(mapping = aes(x = temp.21, y = .epred)) +

geom_line(mapping = aes(group = .draw), alpha = 0.2) +

theme_minimal() +

labs(title = "100 best fit lines simulated from the prior distribution",

x = "Max daily temperature in Celsius (centered at 21°C)",

y = "Total riders recorded") Code breakdown:

Temperature Sequence Creation: The tibble draws_priors is created with a sequence of temperature values from -21 to 15. These temperatures are the input values for which predictions will be generated, ranging from a very cold temperature to a quite hot temperature. Recall that we centered the temperature variable at 21°C — so this range must reflect the centered range of the variable to work properly

Generate Predicted Values: The add_epred_draws() function is used to generate 100 sets of predicted values for the number of bicycle riders (total_counts) based on the model sim_based_on_priors specified earlier.

Combine Predictions with Input Data: The resulting tibble, draws_priors, now contains the original temperature values along with the corresponding predicted values for each of the 100 draws. Each draw implies a possible “best fit line” for the relationship between temperature and the number of bicycle riders, as informed by the prior distributions that we specified.

Plot the best fit lines: Using the temperature scores and the corresponding predictions for number of bicycle riders (total_counts), we can create a line plot using ggplot() — which effectively shows the 100 fitted lines from the 100 draws of the data.

The purpose of this process is to visualize the prior predictive distribution. By plotting these 100 best fit lines, we can assess whether the prior distributions are reasonable and whether they introduce sufficient variability to account for the uncertainty likely present in the actual data. If the lines appear too similar, it may indicate that the priors are too restrictive and need to be adjusted to better capture the possible range of outcomes.

Here’s the output from this process:

Do the plots suggest we’re in good shape? Upon careful review of the prior predictive checks performed with our initial priors — derived from the 2023 data — it is evident that these priors might be too conservative for applying to new data, particularly for 2020, a year markedly impacted by the COVID-19 pandemic. Specifically, the prior standard deviations for the intercept and slope, along with the prior for sigma (\(\sigma\)), yield a predictive distribution with less variability than is likely prudent. For example, there seems to be too little variability in the intercept and slope estimates (as illustrated by the fitted lines across 100 simulated samples). This limited variability suggests that our priors might unduly influence the model’s estimation when applied to the new data from 2020.